Public iNFORMATION

NJEDA ENABLING ACT

“New Jersey Economic Development Authority Act,” N.J.S.A. 34:1B-1 et seq (Updated)

NJEDA RULES

NJEDA BY-LAWS

Amended and Restated By-Laws of the New Jersey Economic Development Authority

NEW RULES / AMENDMENTS

The public is invited to engage with the NJEDA and comment on the draft proposed amendments by submitting written feedback.

NJEDA is offering this opportunity to provide input in addition to, but not as part of, the formal process for rules adoption.

Thank you for sharing your perspectives.

All input submitted through this website will be reviewed by our staff. NJEDA staff will not respond directly to any input, but we may follow-up with you if we need additional clarification on your feedback.

Please observe the following guidelines when submitting your feedback:

PLEASE DO:

- Reference a specific part of the regulations by section and subsection when providing feedback

- Share your feedback, relevant observations, and additional information.

- Keep remarks brief and to the point.

- Use attachments to share more detailed feedback.

PLEASE DO NOT:

- Include information that you do not want to be made public.

- Submit any information or other material protected by copyright without the permission of the copyright owner.

- Submit feedback about topics unrelated to the above specific rules.

We may, at NJEDA’s sole discretion, publish any, all, or a representative sample of input in full or in part.

Do not include any information in your feedback that you do not want to become public. Do not include any personally identifying or contact information if you do not want to be identified. (Providing optional contact information, however, will allow us to follow up with you if clarification is needed.)

We will not accept or agree to a request to keep information confidential.

By submitting material, you grant to the NJEDA the non-exclusive, worldwide, transferable right and license to display, copy, publish, distribute, transmit, print, and use such information or other material in any way and in any medium, including but not limited to print or electronic form.

The public is invited to engage with the NJEDA and comment on the draft Professional Services Rules amendments by submitting written feedback.

NJEDA is offering this opportunity to provide input in addition to, but not as part of, the formal process for rules adoption. Please provide comments before 5pm on March 8, 2024.

Draft Professional Services Rules Amendments:

N.J.A.C. 19:30-8.1, 8.2, 8.3

Thank you for sharing your perspectives.

All input submitted through this website will be reviewed by our staff. NJEDA staff will not respond directly to any input, but we may follow-up with you if we need additional clarification on your feedback.

Please observe the following guidelines when submitting your feedback:

PLEASE DO:

- Reference a specific part of the regulations by section and subsection when providing feedback

- Share your feedback, relevant observations, and additional information.

- Keep remarks brief and to the point.

- Use attachments to share more detailed feedback.

PLEASE DO NOT:

- Include information that you do not want to be made public.

- Submit any information or other material protected by copyright without the permission of the copyright owner.

- Submit feedback about topics unrelated to the above specific rules.

We may, at NJEDA’s sole discretion, publish any, all, or a representative sample of input in full or in part.

Do not include any information in your feedback that you do not want to become public. Do not include any personally identifying or contact information if you do not want to be identified. (Providing optional contact information, however, will allow us to follow up with you if clarification is needed.)

We will not accept or agree to a request to keep information confidential.

By submitting material, you grant to the NJEDA the non-exclusive, worldwide, transferable right and license to display, copy, publish, distribute, transmit, print, and use such information or other material in any way and in any medium, including but not limited to print or electronic form.

Draft Rules for Public Information

Notice(s) of Funding Availability

NJ COOL Program (Published April 15, 2024)

Notice of Funding Availability

The New Jersey Economic Development Authority (“NJEDA” or “Authority”) will begin accepting applications on a rolling, first-come first-served basis for the initially $15,000,000 funded pilot NJ Cool Program (“Program”) on Monday, April 22nd, 2024 at 10:00 AM. The application will remain open until all available funding is reserved or until three (3) years after date of application launch, whichever is sooner. The application can be accessed at www.njeda.gov/njcool.

The Program will provide grants to retrofit projects in existing commercial buildings that result in a reduction of operating greenhouse gas emissions. The Program will support projects located in the municipalities of the City of Newark (Newark), the Township of Edison (Edison), and the City of Atlantic City (Atlantic City).

Purpose and Overview

The goal of this Program is to reduce operating greenhouse gas emissions from the commercial building sector in the State by offsetting capital costs of related construction projects for existing buildings. The Program will also allow NJEDA to assess the effectiveness of funding levels and program design for potential future iterations. Overall, the Program intends to accelerate the adoption of building decarbonization systems, technologies, and construction practices within New Jersey.

On January 29, 2018, Governor Murphy signed Executive Order 7 (EO 7), instructing state government agencies to return New Jersey to full participation in the Regional Greenhouse Gas Initiative (RGGI) as quickly as possible. RGGI is a multi-state, market-based program that establishes a regional cap on carbon dioxide (CO2) emissions from the electric power generation sector and therefore allowing for auctioning of emissions rights. Launched in 2005, RGGI was the first mandatory greenhouse gas “cap-and-invest” program in the United States. States use the proceeds from the CO2 allowance auctions to invest in programs to help further reduce CO2 and other greenhouse gas pollution, spur clean and renewable energy, and provide rate relief on energy bills. Through its participation in RGGI auctions and fixed price allowance sales held between 2020 and 2022, New Jersey received funding that totaled approximately $372 million. In 2023, the first three quarterly RGGI auctions have thus far resulted in over $131 million in funding to the State.

Per the 2023 New Jersey’s RGGI Strategic Funding Plan, the State will deploy RGGI funds for 2023-2025 within four initiative categories:

1. Accelerate Healthy Homes and Building Decarbonization;

2. Catalyze Clean, Equitable Transportation;

3. Strengthen New Jersey’s Forests and Urban Forests; and,

4. Promote Blue Carbon in Coastal Habitats.

New Jersey’s RGGI funds allocation is governed by the Global Warming Solutions Fund Act (P.L. 2008, c. 340). By statute, proceeds from auctions are deposited into the Global Warming Solutions Fund. After administration fees are deducted from the pool, NJEDA receives 60% of the remaining funding for programming (focus area: commercial, institutional, and industrial entities). NJ Board of Public Utilities and NJ Department of Environmental Protection each receive 20% of the remaining funding for programming (focus areas, respectively: low income and moderate income residential; and local government, forests, and tidal marshes).

On November 16, 2023, the NJEDA’s Board approved the creation of this pilot NJ Cool Program, which will utilize an initial $15,000,000 funding from the NJEDA’s allocation of the 2023 RGGI auction proceeds. Funding may increase up to $30,000,000, based upon availability of RGGI funds, if application demand exceeds the initial funding allocation.

Per the 2023 RGI Funding Plan regarding Building Decarbonization:

According to the NJDEP’s New Jersey Greenhouse Gas Inventory, buildings currently are the second highest source of greenhouse gas emissions in the state. These emissions are primarily associated with the combustion of fossil fuels in space and water heating. In addition, hydrofluorocarbon (HFC) emissions from refrigeration and air conditioning account for 6% of the State’s greenhouse gas inventory. HFCs are considered a climate “super pollutant” because these greenhouse gases have hundreds to thousands of times the heat trapping power of carbon dioxide (CO2) and are the fastest growing source of greenhouse gases both internationally and in New Jersey.

New Jersey aims to reduce statewide greenhouse gas emissions compared to 2006 levels by 50% and then 80%–by 2030 and 2050 respectively. Existing building stock will continue to be a significant source of greenhouse gas emissions without decisive action. It is estimated that 80% of buildings that will be around in 2050 already exist today. Governor Murphy’s Executive Order 316 sets clear near-term targets for building electrification in that by December 31, 2030, 400,000 additional dwelling units and 20,000 additional commercial spaces and/or public facilities statewide will be electrified, and an additional 10 percent of residential units serving households earning less than 80 percent of area median income will be made ready for electrification through the completion of necessary electrical system repairs and upgrades. On the longer term, New Jersey’s 2019 Energy Master Plan’s least cost scenario calls for converting at least 90% of residential and commercial buildings from natural gas to electric appliances by 2050. This past September, Governor Murphy signed New Jersey on to a 25-state coalition that aims to collectively reach 20 million heat pump installations across the coalition by 2030.

Per the 2023 RGI Funding Plan regarding Building Decarbonization:

Cost is a major barrier when upgrading homes and businesses to reduce carbon emissions and transition to low GWP commercial refrigeration systems or chillers. Funding the incremental costs to switch heating fuels and shift to new, low global warming potential (GWP) refrigeration systems is necessary to accelerate the installation of these systems. Since many new refrigeration appliances sold today utilize HFCs and will have an average product lifetime of about 15-20 years, New Jersey has a window of opportunity to incentivize the replacement and retrofit of older systems with those that use low and ultra-low- GWP refrigerants. Additional energy reduction benefits will be realized through this initiative because new refrigeration systems that use low-GWP refrigerants are more energy efficient than existing systems.

Program Details

In accordance with the Building Decarbonization initiative in the 2023 RGGI Funding Plan, the NJ Cool Program will support building decarbonization projects in existing commercial buildings in the state. Grants will be provided to reduce the costs of retrofit construction projects in existing commercial building spaces. Grant awards will cover 50% of eligible project costs up to a maximum award of $1,000,000 per project (with a minimum award amount of $50,000 per project).

Projects must include switching 75% or more of building space heating loads from existing fossil fuel-based combustion systems to non-combustion heating systems with low to zero direct operating emissions and/or replacing 75% or more of existing high global warming potential (GWP) refrigerants used for cooling within the building with lower GWP alternatives. In addition, work that further reduces building operating emissions and/or improves energy efficiency of the building can also be considered eligible costs for partial reimbursement through the grant. However, this emissions reduction/energy efficiency work will not be eligible independently for a grant without fuel switching or refrigerant replacement also occurring as part of the overall project requesting a grant award.

Additional eligible emissions reduction/energy efficiency work are hard costs that include, but are not limited to:

- Installing on-site renewable energy generation and/or storage systems

- Replacing gas powered appliances (e.g.: hot water heaters, clothes dryers, kitchen equipment) with electric alternatives

- Installing building management systems or energy load controls

- Conducting weatherization or building envelope (e.g.: façade, doors, windows, insulation) upgrades

- Installing heat recovery equipment

- Replacing lighting with more efficient equipment and/or controls

If the Applicant is a tenant, the minimum 75% switching requirement for heating load or existing refrigerants will only apply to the portions of the building within the tenant’s lease or the building systems affecting the tenant’s space within the overall building.

The Program is focused on three communities in the State: Newark, Edison, and Atlantic City. The three communities were selected for the pilot based on the prevalence of Overburdened Communities (OBCs) as defined by the New Jersey Environmental Justice Law, State geographic representation, and commercial electric and gas usage. Per the law, OBCs are Census block groups with at least 35 percent low-income households; or at least 40 percent of the residents identifying as minority or as members of a State recognized tribal community; or at least 40 percent of the households having limited English proficiency. Census block groups with zero population and located immediately adjacent to an OBC are labeled as “adjacent.” OBCs significantly overlap these three municipalities.

Newark, Edison, and Atlantic City also cover three different geographic regions of the state: North, Central, and South Jersey respectively. Per an analysis conducted with the support of NJDEP, the pilot communities are 3 of the top 4 municipalities in the State by commercial electric usage and are 3 of the top 15 municipalities by commercial natural gas usage. Edison and Newark are the top 2 municipalities in the State based on reported HFC facilities. Overall, the three communities have a significant number of commercial properties that will be potential applicants for the Program.

The total RGGI-funded program budget will be $15,000,000 for grant awards

- $5,000,000 will be initially set aside for each of the three municipality’s projects.

One year after application is open to the public, initial set asides will expire and all remaining program funding will be open to eligible building projects within the three pilot communities on a first come, first served basis.

Eligibility

1. Applicants may own or lease the building space that will be improved using the grant funding. If the space is leased, the Applicant must provide a certification from the landlord/ building owner, that the proposed project details have been reviewed and approved.

2. The Program is open to existing commercial spaces within the three designated pilot communities of Newark, Edison, and Atlantic City. NJEDA will utilize municipal boundaries for these communities in determining that an Applicant’s property address fits the project location criteria.

3. For purposes of the Program, commercial building spaces are classified per a list of select Occupancy Classes as defined in New Jersey Building Code, Chapter 3, as follows:

- Mercantile Group M

- Assembly Group A-2

- Business Group B (excluding airport traffic control towers, buildings used for civic administration, educational purposes above the 12th grade, and post offices).

Note: The three Occupancy classes will provide a variety of commercial building uses to inform program design and operation, and to help inform community members of building decarbonization efforts and benefits. It also allows for mixed-use buildings to be included as Occupancy Class can be applied by code to only a portion of a building rather than the entire building.

4. Improvements (i.e., façade replacement, rooftop solar panel installations, or central HVAC equipment replacement, etc.) that result in emissions/energy reduction benefits to other building occupancy uses within a building, in addition to the primary targeted Group M, A-2, or B occupied spaces, are eligible for grant reimbursement.

5. To prevent duplication of benefits, participants in the NJ Clean Energy New Construction Program (Gut Rehab) or Large Energy Users Program are not eligible to participate in the pilot. In addition, the maximum potential grant award will be calculated from total eligible project costs net the amount of any expected incentive payments from state-run or utility energy efficiency programs.

6. Applicant must be in substantial good standing with the New Jersey Department of Labor and Workforce Development (NJDOL) and New Jersey Department of Environmental Protection (NJDEP) to be eligible for the pilot NJ Cool Program. A current tax clearance certificate will need to be provided prior to application approval to demonstrate the Applicant is properly registered to do business in New Jersey and in substantial good standing with the NJ Division of Taxation.

Eligible Projects

Project scope must include either, but can include both, of the following:

A. Switching 75% or more of building space heating loads from existing fossil fuel-based combustion systems to non-combustion-based heating systems with low to zero direct operating emissions.

B. Replacing 75% or more of existing high global warming potential (GWP) refrigerants with lower GWP alternatives.

Additional, optional, eligible work that further reduces operating emissions and/or improves energy efficiency of the building, includes but is not limited to:

- Installing on-site renewable energy generation and/or storage systems

- Replacing gas powered appliances (e.g.: hot water heaters, clothes dryers, kitchen equipment) with electric alternatives

- Installing building management systems or energy load controls

- Conducting weatherization or building envelope (e.g.: façade, doors, windows, insulation) upgrades

- Installing heat recovery equipment

- Replacing lighting with more efficient equipment and/or controls

Eligible Uses of Funding

Eligible Project Costs:

- Materials, labor, and/or equipment provided by Public Work contractor that are directly related to emissions reductions/energy efficiency improvements or enabling work necessary for proposed emissions reducing/energy efficient building systems to be operational (e.g.: upgrading electric panels, structural improvements for rooftop solar or HVAC systems)

- Equipment and/or materials procured directly by the Applicant that are directly related to emissions reductions/energy efficiency or enabling work necessary for proposed emissions reducing/energy efficient building systems to be operational

Ineligible Project Costs:

- Soft costs: including but not limited to energy audits, design professional services, 3rd party construction management costs, permitting fees, commissioning costs, inspection fees

- Interior finish improvements and upgrades not related to operating energy/emissions reductions (e.g.: flooring, artwork)

- Other building system upgrades that are not related to energy/emissions reductions (e.g.: fire sprinklers, security cameras), even if required for overall building code compliance

- Furniture: non-permanent items (e.g.: desks, chairs, cabinets)

- Prior energy efficiency/emissions reductions improvements begun or completed before time of application approval

- New construction, including enlargements or additions to existing buildings that increase overall building square footage

- Facility or site acquisition

- Fines incurred because of code or zoning violations during construction project(s) associated with this grant

All work must be conducted in accordance with NJ prevailing wage and affirmative action requirements.

Grant Amounts

Grant awards will cover 50% of eligible project costs up to a maximum award of $1,000,000 per project (with a minimum award amount of $50,000 per project).

Grant awards will be calculated based on the quoted costs of the eligible project scope. The Program will not provide reimbursement for costs already incurred prior to application approval.

The maximum potential grant award will be calculated from total eligible project costs net the amount of any expected incentive payments from State-run or utility energy efficiency programs.

Application Submission and Review Process

Complete applications will be reviewed on a rolling basis, first-come first-served.

Applicant submits application to NJEDA, which shall include, among other items:

- Building address and property information (size, type, occupancy, etc.)

- Proof of compliance with eligible building occupancy classes (use) including, but not limited to, an existing building permit, certificate of occupancy, or similar documentation

- Proof of ownership/proof of owner permission

- If Applicant leases space, a copy of their lease and a certification from the landlord that they have reviewed and approved the proposed facility improvement(s).

- If Applicant owns space, a deed, property tax statement, or current mortgage statement from the lender.

- A description of the proposed project

- Photos of the existing building space

- Valid New Jersey tax clearance certificate

- Cost estimate:

- Quote(s) from contractor(s) that are registered with NJDOL as a Publics Works Registered Contractor with costs consistent with New Jersey State prevailing wage rates

- Vendor quotes or similar retailer price information for any relevant items to be purchased directly by the Applicant

- Estimated project schedule

- Requested grant award amount

- Expected utility/state energy efficiency incentive payments (if applicable)

- Green building certification being pursued (if applicable)

- Projected operating greenhouse gas emissions savings as a result of the project (calculated by a qualified professional) with supporting information and additional documentation as required (historic energy bills, HVAC equipment information, etc.)

- Qualified professionals include but are not limited to:

-Licensed engineer (NJ state professional engineer or other state’s equivalent)

-Licensed architect (NJ state registered architect or other state’s equivalent)

-Certified Energy Auditor (CEA certification from the Association of Energy Engineers)

-Certified Energy Manager (CEM certification from the Association of Energy Engineers)

-Energy Management Professional (EMP certification from the Energy Management Association)

-Building Energy Assessment Professional (BEAP certification from ASHRAE)

NJEDA staff will review all applications for completeness and eligibility. At the sole discretion of the Authority, NJEDA staff may ask for any necessary clarifications of the information provided in the application, including, but not limited to, responses, documentation, and attachments. Applicants will be given 10 business days to respond to the clarification requests. If at the end of this period, the applicant is non-responsive, the application will be deemed withdrawn.

Grant Agreement

NJEDA will provide an approval letter to the applicant with the maximum potential grant award available for the project. As a condition of accepting the award and before entering into a grant agreement with NJEDA, the Applicant must provide proof of funding for total estimated project costs plus an additional 15% of overall project costs as contingency to allow for potential cost overruns that may arise during construction. NJEDA grant awards will not be adjusted following notice of application approval and the Applicant will be responsible for any additional or unexpected project costs, even if relevant to the eligible project scope.

The Applicant will have two (2) months from notice of application approval with award amount by the Authority to submit proof of funding for the balance of project costs, with the possibility for additional two-month extension(s) at the discretion of the Authority. Proof of funding can include bank account statements, financing agreement, or similar indication of available working capital for the project costs.

Additional financing provided by NJEDA may be used to cover project costs not eligible under the program. Additional financing provided by NJEDA may also be used to cover project costs paid up front by the Applicant prior to submitting for NJ Cool grant reimbursement.

Upon confirmation of acceptable proof of funding for the balance of project costs from the Applicant, NJEDA will execute a grant agreement with the Applicant for the project. Project construction activity must commence on site within six (6) months of grant agreement execution, or the applicant must demonstrate that permit applications (if required) are pending with relevant building authorities, with the possibility for six-month extension(s) for construction commencement at the discretion of the Authority.

Applicants will have two (2) years from project construction commencement to achieve project completion, with the possibility for six-month extension(s) at the discretion of the Authority.

Disbursement of Funding

Maximum eligible grant award will be determined at time of application approval. NJEDA will disburse funds via payments to the Applicant for reimbursement of eligible project costs at a 50% rate in two payment tranches. Up to one half of the maximum eligible grant award will be available for reimbursement when the applicant has paid 50% or more of estimated eligible project costs. The balance of the grant award will be available for disbursement at project completion when all eligible project work is completed and accepted by the Applicant. Reimbursement will be based on submitted proof of project expenses (receipts, contractor invoices, etc.), signed progress/completion documents, and project photos.

NJEDA reserves the right to conduct site visits during and following completion of construction activities to confirm that work is being completed in accordance with eligible uses for the Program and all prevailing wage and affirmative action requirements. Applicants will be responsible for repayment of all disbursed grant funding if they do not at a minimum complete the work required for either:

- Switching 75% or more of building space heating loads from existing fossil fuel-based combustion systems to non-combustion heating systems with low to zero direct operating emissions; or

- Replacing 75% or more of existing high global warming potential (GWP) refrigerants used for cooling within the building with lower GWP alternatives.

Fees

A non-refundable $1,000 application fee is required at time of application submission, consistent with NJEDA ‘s fee rules, and may be paid by credit card only.

Additional Information

Additional information on the NJ Cool Program may be found at https://www.njeda.gov/njcool/

Questions concerning this Program’s Notice of Funding Availability should be submitted to njcool@njeda.gov The NJEDA is subject to State and Federal statutes including, but not limited to, the following, which may impact affiliates: N.J.S.A. 52:32-60.1, et seq., which prevents the New Jersey government entities from certain dealings with businesses engaged in prohibited activities in Belarus or Russia; Compliance with the list of “Specially Designated Nationals and Blocked Persons” promulgated by the Office of Foreign Assets Control (OFAC), https://sanctionssearch.ofac.treas.gov; N.J.S.A. 24:6I-49 which provides that the following are not eligible for most State or local economic incentives (a) a person or entity issued a license to operate as a cannabis cultivator, manufacturer, wholesaler, distributor, retailer, or delivery service, or that employs a certified personal use cannabis handler to perform work for or on behalf of a cannabis establishment, distributor, or delivery service; and (b) a property owner, developer, or operator of a project to be used, in whole or in part, by or to benefit a cannabis cultivator, manufacturer, wholesaler, distributor, retailer, or delivery service, or to employ a certified personal use cannabis handler to perform work for or on behalf of a cannabis establishment, distributor, or delivery service; and N.J.S.A. 52:13D-12, et seq., which prohibits a member of the Legislature or a State officer or employee or their partners or a corporation in which they owns or controls more than 1% of the stock to undertake or execute any contract, agreement, sale, or purchase of $25.00 or more, made, entered into, awarded or granted by any State agency, with certain limited exceptions.

Atlantic City Food Security Grants Pilot Program (Revised April 12, 2024, Published March 25, 2024)

The New Jersey Economic Development Authority (“NJEDA” or “Authority”) will begin accepting applications for the Atlantic City Food Security Grants Pilot Program (“Program”) on April 2, 2024 at 10:00 AM ET. Applications must be submitted by May 14, 2024 at 5:00 PM. The application can be accessed at: Atlantic City Food Security Grants Pilot Program – NJEDA

The Program will make available up to $5.25 million in grant funding through a competitive application process to eligible applicants for projects that can have a positive impact for Atlantic City residents’ ability to access fresh, affordable, and healthy foods. There will be no application fee for the Program.

español (Spanish)

ATENCIÓN: si habla español, los servicios de asistencia lingüística, gratuitos, están disponibles para usted enviando un correo electrónico a languagehelp@njeda.com.

اللغة (Arabic)

تنبيه: إذا كنت تتحدث اللغة العربية، فإن خدمات المساعدة اللغوية مجانية متاحة لك عبر إرسال بريد إلكتروني إلى

languagehelp@njeda.com.

粵語 Traditional Chinese (Cantonese Chinese)

注意:如果您說粵語,可以透過傳送電子郵件至 languagehelp@njeda.com 免費獲取語言協助服務。

普通语 Simplified Chinese (Mandarin Chinese)

注意:如果您说普通语,可以通过发送电子邮件至 languagehelp@njeda.com 免费获取语言协助服务。

ગુજરાતી (Gujarati)

ધ્યાન આપો: જો તમે ગુજરાતી બોલતા હોય તો, તમારા માટે languagehelp@njeda.com પર ઈ-મેઈલ કરવાથી ભાષા સહાય સેવાઓ મફતામાં ઉપલબ્ધ છે.

हिंदी (Hindi)

ध्यान दें: यदि आप हिंदी बोलते हैं, तो languagehelp@njpa.com पर ईमेल द्वारा, आप के लिए नि:शुल्क भाषा सहायता सेवाएं उपलब्ध हैं।

italiano (Italian)

ATTENZIONE: se parla italiano, può usufruire gratuitamente di servizi di assistenza linguistica scrivendo all’indirizzo languagehelp@njeda.com

한국어 (Korean)

알림: 한국어를 사용하시는 경우, 언어 지원 서비스가 무료로 이메일 languagehelp@njeda.com을 통해 제공됩니다.

po polsku (Polish)

UWAGA: Jeśli mówisz po polsku, możesz uzyskać pomoc tłumacza bezpłatnie wysyłając e-mail pod adres languagehelp@njeda.com.

português (Portuguese)

ATENÇÃO: se você falar português, oferecemos serviços de apoio de idioma gratuitos. Envie um e-mail para languagehelp@njeda.com.

Tagalog

ATTENTION: Kung nagsasalita ka ng Tagalog, magagamit mo ang libreng mga serbisyong tulong sa wika sa pamamagitan ng pag-email sa languagehelp@njeda.com.

Purpose and Overview

In January 2021, Governor Phil Murphy signed the Food Desert Relief Act (FDRA), which allocated to NJEDA a total of $240 million in tax credits over six years, and directed NJEDA to collaborate with the New Jersey Departments of Community Affairs and Agriculture to designate up to 50 Food Desert Communities (FDCs) across the state. These communities are home to more than 1.5 million residents and are in every county in New Jersey. The underlying data analysis allowed the FDCs to be ranked by a Composite Food Desert Factor Score, indicating the acuity or severity of their food desert status. The Atlantic City/Ventnor FDC ranks second highest of all 50 FDCs in New Jersey, indicating an extremely significant need. More than 41,000 people reside within the boundaries of the Atlantic City/Ventnor FDC, which covers the entirety of Atlantic City and a portion of neighboring Ventnor. In order to start initiatives to address FDCs and due to the immediate availability of SLFRF funds for Atlantic City, this pilot Program will focus on Atlantic City.

On October 12, 2023, the NJEDA’s Board approved the creation of the Atlantic City Food Security Grants Pilot Program, a $5,250,000 program funded from the Economic Recovery Fund that will make grants for projects that will strengthen food access and food security in Atlantic City.

Program Details

The Program is designed to address the challenges faced by Atlantic City residents as it related to accessing fresh, affordable and healthy foods. Given the immediate need for improved, reliable and consistent food access in Atlantic City, the Program aims to fund and support 1) entities connecting Atlantic City residents with emergency food programs, 2) creation of programs, services, capital expenditure, or other assistance to entities serving disproportionally impacted households, populations in Atlantic City.

Program grants will be provided to government entities, not-for-profit entities, and for-profit entities that have been in existence for at least two years at the time of application and currently serve, in any manner, residents of the Atlantic City/Ventnor FDC. The grant funds will be awarded only to entities that indicate that they will use the grant funds to improve the quality of life in Atlantic City by increasing food access and/or food security in Atlantic City. Acquisition of land or buildings is not an eligible cost. All other costs that are incurred after the date of grant agreement execution are eligible, subject to the Authority’s approval of the project budget and supporting documentation

In order to provide grant funding to support all eligible projects, a maximum of one Project may be funded per eligible applicant. Grant funding will be allocated to the highest-scoring eligible applicants, proceeding in decreasing order of score until insufficient funds remain to fully fund the next eligible applicant. If funding still remains after approving all qualifying applicants from the initial application period, the application period may be re-opened for additional applications during an additional six-week application window.

Funding

Funding for the Program will come from a $5,250,000 program funded from the Economic Recovery Fund (ERF). The funding is comprised of $4,000,000 in American Rescue Plan Coronavirus State Fiscal Recovery Funds (SLFRF) appropriated for “Atlantic City Initiatives” in the FY2024 Appropriations Act (P.L. 2023, c. 74). Additionally, ($1,250,000) will be reallocated from the Food Retail Innovation in Delivery Grant Program from an FY22 appropriation of State funds for Food and Agriculture Innovation.

Eligibility

Grants will be awarded only to entities that meet the following criteria at the time of application:

- Applicant is a for-profit, nonprofit, or government entity that has been in existence for at least two years at the time of application;

- Applicant currently serves, in any manner, residents of the Atlantic City/Ventnor FDC;

- Applicant can demonstrate existing programming or services related to food access and/or food security, including but not limited to: food distribution, nutrition education, local agriculture, and/or food retail (such programming may be different than the food security or food access activities proposed for the grant); and

- All applicants must be in substantial good standing at the time of application with the following New Jersey Departments:

- Department of Labor and Workforce Development (“NJDOL”)

- Department of Environmental Protection

- Division of Taxation, as evidenced by a Tax Clearance Certificate

- Applicant is not subject to suspension or debarment in accordance with 2 CFR § 200.214 and its implementing regulations, including Executive Orders 12549 and 12689, 2 CFR part 180.

Eligible Uses

Grant funding can only be used for prospective costs of the Project specifically approved based on the application, Authority review, and the grant agreement. Grant funds will be awarded only to entities that indicate that they will use the grant funds to improve food access and/or food security in Atlantic City.

The proposed use(s) must be accomplished within two years of execution of the grant agreement, subject to two 6-month extensions by EDA staff if the grantee is diligently pursuing the use and the delay was unforeseeable and not in the grantee’s control, to the extent allowed under federal spending deadlines.

As required by law, construction, including use of trades in construction related to installation of equipment, will be subject to State affirmative action requirements for contractors. Such work with a cost of $2,000 or more will be subject to New Jersey prevailing wage requirements and the Authority’s prevailing wage and affirmative action requirements. Additionally, grantees must utilize contractors registered as a New Jersey Public Works Contractor with the NJDOL for work, subject to Prevailing Wage.

Awards will be subject to federal Duplication of Benefits requirements and, if construction is included, to cost reasonableness analysis.

Grant funding cannot be used for the acquisition of land or buildings as an eligible cost. All other costs that are incurred after the date of grant agreement execution are eligible, subject to the Authority’s approval of the project budget and supporting documentation. For example, eligible costs include construction, equipment, installation, salaries and fringe, and rent.

Grant Amounts

The minimum grant funding is $50,000 per project. The maximum grant funding is $500,000 per project. Grant funds may cover up to 100 percent of the proposed project costs. If grant funds from EDA are not requested to cover 100 percent of the proposed project costs, additional funding sources must be described in the budget and budget narrative submitted for approval.

The potential award amount is based upon current information about funding availability. NJEDA reserves the right to increase that amount and number of awards should additional funds become available.

Application Submission and Review Process (including Scoring)

Applications for the Program will not be accepted after the deadline of May 14, 2024 at 5:00pm. To apply, an applicant must register, or log into the online application portal, complete all required application questions fully, and upload all required PDF documents.

NJEDA staff will review all applications for completeness and eligibility. At the sole discretion of the Authority, NJEDA staff may ask for more information for the application, including, but not limited to, responses, documentation, and attachments. Applicants will be given 10 business days to respond to these requests. The Authority reserves the right to provide two additional 10 business day cure periods if necessary. Should another cure period be provided, it will be provided to all applicants. If at the end of the cure period, or cure periods if two or three cure periods are provided, the applicant is non-responsive, the application will be deemed withdrawn. No applications will be scored until the end of any and all cure periods.

Each application must provide information about their organization and their proposed project, including, but not limited to:

- A detailed description of the proposed project, including its expected impact on FDC residents’ food access and/or food security in Atlantic City. This description must include, at minimum, the following:

- Description of current food security and food access needs and challenges in Atlantic City;

- Description of how the proposed project will address food access and food security in Atlantic City, particularly for SNAP and WIC recipients;

- Identification of other key stakeholders and description of how the applicant will collaborate with them;

- An implementation timeline and work plan. The work plan must include, at minimum:

- Specific Measurable Achievable Relevant Time-bound (SMART) objectives;

- Description of each project activity;

- A project timeline, including milestones and the length of time needed to implement each activity within the grant period;

- Identification of appropriate staff responsible for each project activity;

- A description of the organization’s capacity to undertake the proposed project, including current and past experience a) serving residents of the Atlantic City/Ventnor FDC and b) providing programming or services related to food access and food security in Atlantic City and/or other parts of New Jersey;

- A description of community engagement efforts, which can include letters of support for the proposal; and

- A line-item budget and budget narrative for the proposed project scope. The requested level of funding must be broken down by line item. Line items must be clearly explained in the budget narrative. The requested level of funding must be reasonable for proposed activities within the project timeline. If the total project cost exceeds the requested grant amount, the budget narrative must describe the sources for all other funds.

Note: Project viability and readiness to proceed/timelines are scoring factors and considerations. Applicants should provide as much detail as possible regarding the steps involved and projected timeline for the proposed project.

For projects involving Construction Cost and Construction Related Cost, the following requirements must be met:

- NJDOL Public Works Registered Contractor/Subcontractor

All contractors used for any construction costs of $2,000 or more must be registered as a New Jersey Department of Labor and Workforce Development (DOL) Public Works Contractor Registered Contractor and must abide by NJ prevailing wage and affirmative action requirements. Any quotes submitted from contractors/subcontractors that are not NJDOL Public Works Registered Contractors at the time of application will not be eligible to be used in your proposed project. - Professional Services

All professional services, including, but not limited to, architectural, engineering, construction management services, must provide proof of a NJ Business Registration and a Verification of Professional Service form.

Scoring

Applications that are incomplete, including those that do not provide responses to all required questions and those that do not meet the applicant eligibility criteria, will not proceed to scoring. Applications deemed complete will be reviewed and scored by an evaluation scoring committee that will be comprised of NJEDA staff. Applications will be scored on a scale of 0 – 100 points. To be considered for grant funding, a minimum score of 50 out of 100 points is required. Applications will be scored based on the following criteria:

- Criteria # 1: Project Description/Statement of Work (up to 30 points) – Factors considered include:

- Applicant’s understanding of Atlantic City’s needs and challenges regarding food security and food access;

- Potential impact of the proposed project on Atlantic City residents’ food access and/or food security;

- Potential impact of the proposed project on food access for recipients of federal and state nutrition benefits, including SNAP and WIC;

- Potential for project to be viable, sustainable, and adaptable to other Food Desert Communities;

- Criteria # 2: Work Plan (up to 20 points) – Applications will be evaluated based on factors, including:

- Feasibility of work plan, as proposed;

- Level of detail and evidence of thorough planning;

- Criteria # 3: Organizational Capacity (up to 20 points) – The applicant is equipped to successfully complete the proposed plan in a timely manner. Factors considered include:

- Applicant’s experience providing programs or services related to food access and/or food security, including, but not limited to, food distribution, nutrition education, local agriculture, and/or food retail;

- Applicant’s experience working effectively on collaborative, multi-stakeholder projects, as applicable for the proposed project;

- Alignment of proposed project with applicant’s overall mission or primary line of business

- Criteria #4: Community Engagement (up to 20 points) – Factors considered include:

- Depth of experience serving residents of Atlantic City;

- A track record of seeking and responding to feedback from stakeholders, such as community members, customers, or advocates;

- Efforts to ensure programs or services promote social and economic equity;

- Ability to consider and mitigate obstacles that have created challenges for food security and food access in the past;

- Criteria #5: Budget and Budget Narrative (up to 10 points) – Applications will be evaluated based on level of detail, clarity of justification/explanation of budget, budget narrative with a clear connection to project goals and reasonableness.

Funding will be allocated first to the highest-scored applicant, proceeding in decreasing order of score to other applicants that meet the minimum score requirement of 50 out of 100 points, until insufficient funds remain to fully fund the next eligible application. If funding still remains after approving all qualifying applicants from the initial application period, the application period may be re-opened for additional applications during an additional six-week application window. Applications received during that window will be reviewed and scored following the same procedure.

Grant Agreement

Once a project is approved for funding, the Authority will enter into a grant agreement (“Grant Agreement”) with the applicant detailing the project to be funded, eligible Project costs, the amount of grant funding, and all financial programmatic requirements, including the amount of other funding as may be applicable. The Grant Agreement will detail timelines for both the Project and Project reporting. The proposed use(s) must be accomplished within two years of execution of the grant agreement, subject to two 6-month extensions, at the discretion of EDA staff, if the grantee is diligently pursuing the use and the delay was unforeseeable and not in the grantee’s control, to the extent allowed under federal spending deadlines. The applicant will be responsible for ensuring compliance of the Project with all terms and conditions of the Grant Agreement and the Program funding requirements.

Grant Funding Disbursements

The Authority will disburse grants only to the applicant for the eligible and approved scope of work. Funds will be disbursed according to the following schedule:

- 50 percent of the grant will be disbursed upon execution of a grant agreement between NJEDA and the selected applicant;

- 25 percent of the grant will be disbursed upon the applicant’s submission of the mid-program report, the exact timing to be determined based on the grantee’s implementation plan and reflected in the grant agreement; and

- 25 percent of the grant amount will be disbursed upon the Authority’s review and approval of the applicant’s submission of a final report on completion of the proposed project, expected to be no later than two (2) years following the date of the grant agreement execution or September 30, 2026, whichever is earlier.

Post-Closing Compliance

Grantees will be required to report to NJEDA at least quarterly, including mid-program and final reports, starting at grant execution and extending through the end of the grant term. These reports must provide updates on grantees’ progress against their proposed project timeline, data and outcomes on the project’s impact (e.g. number of people served), and project costs, both cumulative and since the last report.

NJEDA shall recapture any grant funds used for (1) an ineligible purpose or (2) any purpose outside of any approved scope of work.

Fees

No application fees will be charged for this program, per NJEDA’s fee rules.

Additional Requirements and Information

Comprehensive information about the Atlantic City Food Security Grants Pilot Program is available at Atlantic City Food Security Grants Pilot Program – NJEDA.

Questions concerning this Program’s Notice of Funding Availability should be submitted to FoodSecurityGrants@njeda.gov.

The NJEDA is subject to State and Federal statutes including, but not limited to, the following, which may impact affiliates: N.J.S.A. 52:32-60.1, et seq., which prevents the New Jersey government entities from certain dealings with businesses engaged in prohibited activities in Belarus or Russia; Compliance with the list of “Specially Designated Nationals and Blocked Persons” promulgated by the Office of Foreign Assets Control (OFAC), https://sanctionssearch.ofac.treas.gov; N.J.S.A. 24:6I-49 which provides that the following are not eligible for most State or local economic incentives (a) a person or entity issued a license to operate as a cannabis cultivator, manufacturer, wholesaler, distributor, retailer, or delivery service, or that employs a certified personal use cannabis handler to perform work for or on behalf of a cannabis establishment, distributor, or delivery service; and (b) a property owner, developer, or operator of a project to be used, in whole or in part, by or to benefit a cannabis cultivator, manufacturer, wholesaler, distributor, retailer, or delivery service, or to employ a certified personal use cannabis handler to perform work for or on behalf of a cannabis establishment, distributor, or delivery service; and N.J.S.A. 52:13D-12, et seq., which prohibits a member of the Legislature or a State officer or employee or their partners or a corporation in which they owns or controls more than 1% of the stock to undertake or execute any contract, agreement, sale, or purchase of $25.00 or more, made, entered into, awarded or granted by any State agency, with certain limited exceptions.

Food and Agriculture Research & Development Pilot Seed Program (Published April 5, 2024)

Notice of Funding Availability

The New Jersey Commission on Science, Innovation and Technology (“CSIT”) will launch an online application for the Food and Agriculture Research & Development Pilot Seed Grant Program at 9 am on April 12, 2024 at www.njeda.gov/csit. Application will close on May 10, 2024 at 5 pm. The Food and Agriculture Research & Development Pilot Seed Grant Program has a total budget of $375,180 for an estimated 5 grant awards of up to $75,000 each. This is a competitive grant. No application, transaction, or termination fees will be collected by CSIT for this Program.

Purpose

The Food and Agriculture Research & Development Pilot Seed Grant Program (“Program”) supports innovation from researchers and entrepreneurs focused on developing technology and other solutions to addressing food insecurity in New Jersey (“NJ”). The Program will engage early stage innovation-based companies to accelerate research and development of technologies into commercially viable products and services that address food insecurity needs of communities across NJ. The Program seeks to identify and implement ways to increase access to nutritious

foods and develop new approaches to alleviate food deserts (referred to as an area with a lack of access to healthy, affordable food). Follow the link to see a list of current NJEDA New Jersey Food Deserts (Food Desert Communities Designation) The Program supports the development of

innovative technologies within the target areas listed below.

The Program is focused on companies conducting research and development or testing technologies in the following target areas:

Life Sciences (e.g., Next generation crop, soil health, indoor agriculture, and aquaculture)

- Technology (e.g., Digital services and platform development for improved food access, digital services to reduce food waste, digital platform to access emergency food and other services necessary for food security)

- Food and Beverage (Non-retail) (e.g., Improved connection between urban food systems and rural and urban communities to improve food access, increased capacity, and distribution of farm fresh products)

- Transportation and Logistics (e.g., online platform designed to facilitate business-to business connections with local food systems to address disruptions to the local food supply, innovative food delivery models with reduced carbon footprint)

All applicants for the Program must provide proof of concept for their project proposed for funding.

Overview

The total funding of $750,000 for the Program comes from New Jersey Economic Development Authority’s (“NJEDA”) Fiscal Year 2022 (“FY2022”) appropriations for “Food and Agriculture Innovation” via a Memorandum of Understanding between NJEDA and CSIT. The Program is

implemented by CSIT.

Of the total Program budget, $375,180 remains for the current round of grants. The Program will award grants of up to $75,000 to support an estimated five New Jersey early-stage innovation based companies that have the potential to impact food and agriculture outcomes. Decisions on

this grant award are expected to be made by the 3rd quarter of 2024.

Program Details

Grants will be awarded on a competitive basis, with awards going to the highest scoring applicants provided the minimum score of 70 points is met.

Applicants can only submit one application for this grant. Multiple applications from the same company will NOT be accepted. If an applicant submits two applications, they must select which application moves forward for review and scoring.

Each grant will be valid for a period of twelve months, effective from the date of the execution of the grant agreement. Any unused approved grant amounts will be cancelled after the twelve month period and returned to the CSIT program budget for future use. An extension of up to

three months may be permitted at the discretion of CSIT.

Please note that CSIT if CSIT notifies a grant applicant of a budget error they may adjust and resubmit grant budgets to address the following issues: if:

i. Submitted budget at the time of application exceeds the approved grant amount

ii. Submitted budget at the time of application includes ineligible budgetary items as stated in notice of funding

iii. Submitted budget at the time of application exceeds the 30% threshold, as stated in the notice of funding below under “Eligible Uses”

iv. Submitted budget at the time of application does not include printed name of preparer and date

Applications with incorrect budgets that are not revised by June 5, 2024 will be rejected.

Eligibility

Each applicant must meet the following eligibility criteria at the time of application and maintain eligibility during the entire review period in order to be eligible for an award:

- Be authorized and in good standing to conduct business in NJ as evidenced by a current NJ tax clearance certificate addressed to CSIT. All certificates listing another state agency will be rejected.

- Have no more than twenty-five full-time equivalent (“FTE”) workers (FTE calculated on a 35-hour work week) at the time of application.

- Have a minimum of one full time worker. A worker may be the founder and may be paid or unpaid.

- Conduct 50% or more of the cumulative hours worked by all workers, founders, and contractors in a New Jersey location (calculated on an FTE basis – 35 hrs. per week);

and - Have less than or equal to $2,000,000 in 2023 calendar year sales revenue (excluding grant revenue).

Eligible Uses

The grant funding can be utilized for project research and development activities. In addition, the following expenses are eligible uses but cannot total more than 30% of the Project budget:

In addition, the following expenses are eligible uses but cannot total more than 30% of the Project budget:

- Marketing and customer discovery specific to the innovation

- IP Patent prosecution and licensing-related expenses

- Conference registration fees

Ineligible Uses

The following expense categories are ineligible for funding by this grant:

- Direct services to individuals or organizations

- Manufacturing of products for sale or commercial use

- Real estate rental expenses

- Patient clinical trial expenses

- Construction costs

- Travel, entertainment, and other similar expenses

- General overhead expenses

- Expenditures incurred before the execution of the grant agreement

- Expenditures for equipment and materials that applicant does not use for the project during the project period

- Fees related to conferences not associated with the project

Disbursement of funds

First disbursement will equal 80% of grant award on the effective date of the grant agreement. Second disbursement of 20% of grant award will be after Final Report is submitted and approved by CSIT.

Application Submission and Review Process

All applications to the Program must include the following documentation:

a. Completed online application

b. Evidence that proof of concept has been achieved for the project. Submit one of the following:

- Description of the proof-of-concept results

- Published paper outlining results achieved

- Successful completion of a federal SBIR/STTR grant or contract related to the

project - Documentation from a university tech transfer office if the project relates to

technology that has been developed at a university

c. Budget and Milestone Proposals (Excel template embedded within online application)

d. Employee information as appropriate for applicable company structure and staffing-i.e. most recent NJ WR-30 (W2 employees) or 1099 (contractors), Shareholder Agreement or K-1, or offer letters. Please note that if a Professional Employment Organization (“PEO”) is utilized,

the applicant must submit confirmation of PEO-A form issued by the NJ Department of Labor (“DOL”). These confirmations are issued on an annual basis and are valid for a year. See https://www.nj.gov/labor/ea/employer-services/leasing-companies/ for additional information

on PEOs.

e. Summary of most recent internal payroll (Q4 2023 or Q1 2024) indicating each employee name

and number of hours worked per week.

f. Most recent company tax filing: Federal 941 and either an NJ-CBT-100 (Schedule A), Form-1065 or Form -1040 (Schedule C) or whichever is applicable to the organizational form of the business, showing the total Gross Receipts or Sales for the year.

g. Current NJ tax clearance certificate addressed to CSIT Tax clearance must be dated March 8, 2024 or after. https://www16.state.nj.us/NJ_PREMIER_EBIZ/jsp/home.jsp DUE No Later Than June 5, 2024 or application will be rejected.

h. If applicable, copy of Women and/or Minority owned business NJ certification https://www.njportal.com/DOR/SBERegistry/Default/ DUE No Later Than June 5, 2024 or relevant bonus points will not be awarded.

i. If applicable, copy of Veteran owned business NJ certification DUE No Later Than June 5, 2024 or relevant bonus points will not be awarded.

j. If applicable, a copy of Executed University License Agreement with University. DUE No Later Than June 5, 2024 or relevant bonus points will not be awarded.

k. Complete Application Certification

l. Completed CSIT Legal Debarment Questionnaire

m. For companies with a d/b/a or “doing business as” name, we require proof of business

registration for the d/b/a name.

The following steps detail the application submission process:

- A document completeness review will be done as applications are received.

- Applicants with missing documentation will be notified and given 10 business days to submit missing documents. If the application remains incomplete by the resubmission deadline, it will be rejected.

- Only complete applications will be evaluated and scored. Applicants must submit the NJ tax clearance certificate by June 5, 2024 otherwise, the application will be rejected. For any bonus points category, if the documentation is not received by the application scoring period, bonus points will not be applied.

- Denied applications may appeal CSIT’s declination, provided they do so within the timeframe provided in CSIT’s declination letter. Appeals must be written and include an explanation as to how the applicant has met all the eligibility criteria.

Scoring

An evaluation committee comprised of CSIT and NJEDA staff will review and assign a score to each application, after receiving qualitative input from Subject Matter Experts (“SME”s). As part of the process, all applicants with complete applications will be invited, but are not required, to make a brief presentation about their project and submit it to the evaluation committee and SMEs.

All applicants must achieve a minimum score of 70 (out of 100 points) in the following criteria to be eligible for a grant.:

- Innovation (up to 30 points)

- Market opportunity (up to 10 points)

- Implementation plan – budget and milestones (up to 20 points)

- Go-to-market strategy (up to 10 points)

- Economic and community impact (up to10 points)

- Team (up to 20 points)

Bonus Points – Bonus points will be awarded to applicants that achieve the minimum score and are also:

- A company using technology initially developed at a NJ university, under an executed

license agreement with such university (15 points) - NJ certified women-owned business (10 points)

- NJ certified minority-owned business (10 points)

- NJ certified veteran-owned business (10 points)

- Primary place of business/research & development located within an opportunity zone

eligible census tract or government restricted municipality (5 points) - Has not previously received a CSIT grant or voucher (10 points)

Grants will be awarded to an estimated five applicants with the highest overall scores, provided the minimum score is met, until program funds are expended.

Board Approval

The CSIT Program Committee will review scored applications and make funding recommendations to the CSIT Board. The CSIT Board will make final decision on grant award winners and declination on or about 3rd quarter 2024.

Fees

No application, transaction, or termination fees will be collected by CSIT for this program.

Additional Information

For two years from the date of the grant agreement, workers and consultants who continue working

on the project must conduct at least 50% of their work in a New Jersey location. Failure to comply will trigger a requirement that the applicant make full re-payment of the grant award.

All grant awardees must report economic impact data to CSIT upon the completion of the project and for an additional two years after project completion by submitting an “Economic Impact Questionnaire” provided by CSIT.

All grant awardees are encouraged to host one in-person interim site visit from the CSIT/NJEDA team or a virtual meeting to provide an update on their project.

All grant awardees are encouraged to commit to participate in future CSIT/NJEDA alumni activities, such as serving as a panel member or being interviewed about their program experience.

Confidentiality

Applications received will be reviewed only by staff of CSIT and NJEDA and SMEs. All applications submitted may be subject to requests for public disclosure, including but not limited to requests pursuant to the Open Public Records Act (“OPRA”), N.J.S.A. 47:1A-1 et seq. If the applicant believes that information contained in its proposal merits confidential treatment pursuant to OPRA, any such purportedly confidential information submitted to CSIT must be specifically identified and marked by the applicant as such.

Contact Information

All questions concerning this Notice of Funding Availability must be directed to CSIT by email to csitfoodagr@njcsit.gov. All answers will be posted publicly in the form of a Frequently Asked Questions (FAQs) document which will be posted on the CSIT website prior to the application

deadline. Website: https://www.njeda.gov/csit.

Email: csitfoodagr@njcsit.gov

The NJEDA is subject to State and Federal statutes including but not limited to the following which may impact affiliates: N.J.S.A. 52:32-60.1, et seq., which prevents the New Jersey government entities from certain dealings with businesses engaged in prohibited activities in

Belarus or Russia; N.J.S.A. 24:6I-49 which provides that the following are not eligible for most State or local economic incentives (a) a person or entity issued a license to operate as a cannabis cultivator, manufacturer, wholesaler, distributor, retailer, or delivery service, or that employs a

certified personal use cannabis handler to perform work for or on behalf of a cannabis establishment, distributor, or delivery service; and (b) a property owner, developer, or operator of a project to be used, in whole or in part, by or to benefit a cannabis cultivator, manufacturer, wholesaler, distributor, retailer, or delivery service, or to employ a certified personal use cannabis handler to perform work for or on behalf of a cannabis establishment, distributor, or delivery service; and N.J.S.A. 52:13D-12, et seq., which prohibits a member of the Legislature or a State officer or employee or their partners or a corporation in which they owns or controls more than 1% of the stock to undertake or execute any contract, agreement, sale, or purchase of $25.00 or more, made, entered into, awarded or granted by any State agency, with certain limited exceptions.

Commuter and Transit Bus Private Carrier Relief and Jobs Program – Phase 2 (Published February 26, 2024)

Notice of Funding Availability

The New Jersey Economic Development Authority (NJEDA) will begin accepting applications for the non-competitive Commuter and Transit Bus Private Carrier Relief and Jobs Program – Phase 2 (“Program”) at 10:00 AM on Tuesday, March 5th, 2024. The deadline to apply is 3:00 PM on Thursday, March 28th, 2024. The application can be accessed at https://www.njeda.gov/busreliefphase2/

Purpose and Overview

On November 16th, 2023, the NJEDA’s Board approved the grant funding for Phase 2 of the Commuter and Transit Bus Private Carrier Relief and Jobs Program. Subsequently, on February 7th, 2024, the board approved an amendment to the award calculator. Similar to Phase 1, Phase 2 offers a one-time grant to eligible commuter and transit bus private carrier companies in New Jersey. This Program continues to assist these companies in addressing ongoing revenue losses, which have not been addressed through any other funding sources (“unmet need”), due to the evolving economy and reduced ridership stemming from the shift towards remote work in a post-pandemic economy.

Supporting the State’s private carrier industry will contribute to the overall well-being of communities, help maintain essential transportation services, and foster economic resilience within the state. Incorporating the policy of providing relief grants to private carrier companies facing reduced ridership due to remote work not only addresses their financial challenges, but also advances the State’s priority of investing in communities and infrastructure. By adapting to the evolving transportation landscape, these private carriers can continue to serve their communities effectively, contributing to the overall success of the State’s development goals. Additionally, this Program aims to support job retention and creation, as well as benefit New Jersey residents who rely on the State’s commuter bus services and residents employed by the private carrier companies.

To receive funding, applicants must meet all eligibility criteria described below. The Program funds will be allocated on a predefined formula to ensure the Program can be efficiently administered. The potential award amount is based upon current information about funding availability; NJEDA reserves the right to increase that amount and number of awards should additional funds become available.

Funding

This Program is funded by utilizing the $12 million that was appropriated to the Authority in the SFY2024 State Budget for Phase 2 of the Commuter and Transit Bus Private Carrier Relief and Jobs Program.

Eligibility

To streamline the program and ensure the Authority can efficiently deploy this funding, program eligibility will be based on certain non-discretionary criteria, and grant amounts will be calculated based on a predefined formula. (See below.) To be eligible, an applicant must demonstrate the following in a manner acceptable to the Authority:

- Have been in business prior to February 15, 2020;

- Be a for-profit business (non-profits are excluded from the Program based on other required criteria). Note: Public Agencies, authorities, governmental entities or the like are NOT eligible

- Be registered to do business in and operating in the state of New Jersey, as evidenced by a current New Jersey Tax Clearance Certificate;

- Provide fixed route bus service (MB) or commuter bus (CB) service, as defined in the Federal Transit Administration’s December 22, 2021, National Transit Database (NTD) Glossary. Note: Other services, including, but not limited to, those provided by charter buses, school buses, municipal shuttles, vanpool, and on-demand bus services, are not eligible;

- Have reported Vehicle Revenue Miles for fixed route bus service (MB) or commuter bus service (CB) greater than 0 in New Jersey directly to the NTD, as recorded in Annual Data Tables 2022 Service, or through NJ Transit as a private carrier in 2022;

- Demonstrate systemic decrease in revenues (losses) in the state of New Jersey in 2022,due to the new realities in working habits (calculated as the difference between each applicant company’s 2022 NJ-generated revenues and 2019 NJ-generated revenues, as reported in the respective NJ CBT-100 or CBT-100S tax returns, Schedule J) that has not been fully addressed by other public or private relief funding sources;

- Certify bus service, through peak vehicle requirements or notice of service changes, has not voluntarily reduced since 2021, from time of application, at milestone stages, and through the end of the grant compliance period;

- Satisfy the Authority’s debarment/disqualification review, and not have any defaults or outstanding obligations to the Authority; and

- Be in good standing with the following sister agencies: New Jersey Department of Labor, New Jersey Department of Environmental Protection, New Jersey Department of Taxation, and New Jersey Transit.

Eligible Uses:

Grant funding may be used for reimbursement of “unmet need”, as discussed below.

Grant Amounts

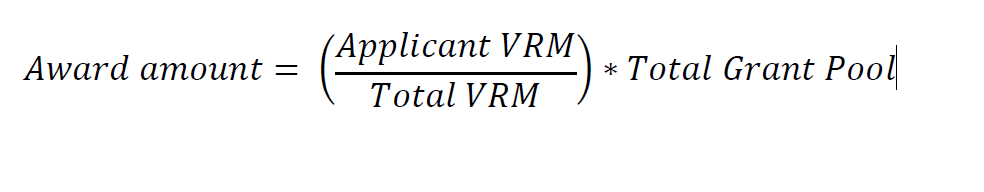

Grant amounts will allocate funds based on each eligible applicant’s proportional share of the total eligible applicant’s vehicle revenue miles (VRM) in New Jersey for 2022, Any leftover funds would be reallocated proportionally based on VRM. The basic formula is shown below.

Total grant pool = $11,400,000

Applicant VRM = Vehicle Revenue Miles submitted to NTD for NJ in 2022

Total VRM = Sum of Vehicle Revenue Miles submitted to NTD for NJ in 2022 for all eligible applicants

Total base awards = Sum of base awards for all applicants

The maximum award will not exceed the applicant’s unmet need. The unmet need is defined as 2022 New Jersey revenue losses (calculated as the difference between each applicant company’s 2022 revenues reported in New Jersey and 2019 revenues reported in New Jersey) less any other public or private funds that a company received for 2022.

Any funding that exceeds unmet need will be re-allocated to the pool proportionally based on vehicle revenue miles, to be disbursed to other eligible applicants.

Application Process

Upon closure of the application period, the Authority will review applications for completeness. Applicants that submitted incomplete applications will be provided the opportunity to correct the applications to include the missing information within 10 business days.

At the sole discretion of the Authority, staff may ask for clarification of the information included in the application, including but not limited to narrative responses, supporting documentation, and attachments. Applicants will have 10 business days thereafter to provide missing or incomplete documents.

Disbursement of Funding

In recognition of the ongoing commitment to sustain essential service providers and ensure that funding aligns with evolving service demands, Phase 2 of the Program will introduce a milestone-based disbursement process. As part of this approach, successful applicants will receive half of their awarded funds upon the completion and execution of the grant agreement.

The second disbursement of the remaining half of the award, will be contingent upon the outcome of the 2024 NJ Transit review of peak vehicle requirements, which will be available in Q3 2024. Approved applicants will only receive their final disbursement once NJ Transit confirms no variances in peak vehicle requirements. In the event of that NJ Transit’s review of peak vehicle requirements confirms that there is less than amount confirmed at the time of application, or if there is a notice of decreased service, the awardee will forfeit the remaining reserved approved funds.

In the event an awardee forfeits the remainder of their grant funds, the funds will be redistributed to the remaining eligible awardees and disbursed accordingly.

No application fees will be assessed, per the NJEDA’s revised fee rules.

Additional Information

Additional information on the Commuter and Transit Bus Pandemic Relief and Jobs Program may be found at https://www.njeda.gov/busreliefphase2/

The NJEDA is subject to State and Federal statutes including but not limited to the following which may impact affiliates: N.J.S.A. 52:32-60.1, et seq., which prevents the New Jersey government entities from certain dealings with businesses engaged in prohibited activities in Belarus or Russia; N.J.S.A. 24:6I-49 which provides that the following are not eligible for most State or local economic incentives (a) a person or entity issued a license to operate as a cannabis cultivator, manufacturer, wholesaler, distributor, retailer, or delivery service, or that employs a certified personal use cannabis handler to perform work for or on behalf of a cannabis establishment, distributor, or delivery service; and (b) a property owner, developer, or operator of a project to be used, in whole or in part, by or to benefit a cannabis cultivator, manufacturer, wholesaler, distributor, retailer, or delivery service, or to employ a certified personal use cannabis handler to perform work for or on behalf of a cannabis establishment, distributor, or delivery service; and N.J.S.A. 52:13D-12, et seq., which prohibits a member of the Legislature or a State officer or employee or their partners or a corporation in which they owns or controls more than 1% of the stock to undertake or execute any contract, agreement, sale, or purchase of $25.00 or more, made, entered into, awarded or granted by any State agency, with certain limited exceptions.

New Jersey Manufacturer’s Voucher Program Phase 2 (Published February 5, 2024)

Notice of Funding Availability

The New Jersey Economic Development Authority (“NJEDA” or “Authority”) will begin accepting applications for the pilot Phase 2 – New Jersey Manufacturer’s Voucher Program (“NJ MVP Phase 2” or “Program”) on February 12, 2024 at 10:00am EST. Applications will be accepted until all funds are fully awarded.

The pilot Phase 2 Program will make available $20 million in grant funding through a rolling application process to provide New Jersey manufacturers with access to essential equipment, which will enhance efficiency, productivity, and overall profitability in New Jersey.

A fee of $1,000 is required at the time of application. The application can be accessed online at: https://www.njeda.gov/mvp2/

Purpose and Overview

The pilot NJ MVP Phase 2 Program will provide support to New Jersey priority sectors and manufacturers that purchase equipment that integrates advanced or innovative technologies, processes, and materials to improve the manufacturing of products. This pilot Program will continue to stimulate private sector investments to modernize New Jersey’s manufacturing industry, and to help keep pace with state-of-the art product development and manufacturing technology. Eligible applicants will receive a reimbursement of equipment costs sized at 30% – 50% of the cost of the eligible equipment (including installation) up to a maximum award amount of $250,000.

Note: The potential award amount is based upon current information about funding availability; NJEDA reserves the right to increase that amount and number of awards should additional funds become available.

Funding

On June 30, 2023, Governor Murphy allocated $20 million from the Fiscal Year 2024 State Budget NJEDA for deposit into the Economic Recovery Fund (ERF) for the New Jersey Manufacturer Voucher Program Phase 2. Of that allocation, up to $4,000,000 will be used to provide funding to eligible Phase 1 waitlist applicants. Pursuant to N.J.S.A § 34:1B-7.13(a)(12), ERF Funds can be utilized “to provide grants or competition prizes to funds initiative-based activities which stimulate growth in targeted industries as defined by the authority’s board or supports increasing diversity and inclusion within the State’s entrepreneurial economy.” NJMVP, as a grant program stimulating growth in Advanced Manufacturing or manufacturing activities in any of the other “targeted industries”, is an eligible use of ERF funding.

Program Details