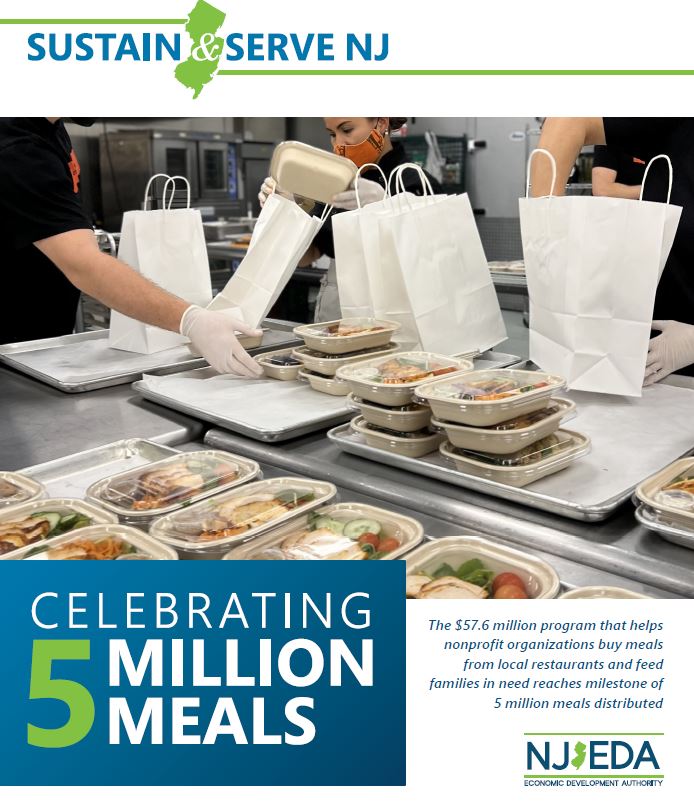

SUSTAIN AND SERVE NJ

Sustain & Serve NJ (SSNJ) makes grant funding available to eligible nonprofit organizations for increases in costs associated with purchasing meals from New Jersey-based restaurants that have been negatively impacted by COVID-19 and distributing those meals at no cost.

In the News

How to Feed the Hungry While Helping Struggling Restaurants Survive – The New York Times

PROGRAM DETAILS

Sustain & Serve NJ (SSNJ) was born, as a $2 million pilot program launched in December 2020 that made grant funding available for expenses directly associated with purchasing meals from New Jersey-based restaurants that were negatively impacted by COVID-19 and distribute the meals for free to the community. Through Phase 1, 2 and 3 SSNJ surpassed our wildest expectations— the program has supported more than 5.3 million meal purchases from over 450 restaurants across the state and has grown to nearly $57.6 million in awards.

While SSNJ may be winding down, NJEDA’s will continue to answer the Clarion Call of combatting food Insecurity and investing in communities.

ELIGIBILITY

Phase 3 Grantee Eligibility Criteria

Changes in bold represent changes from Phase 1 and 2 of the program

Phase 3 of SSNJ is open to 501(c)(3) and 501(c)(19) non-profit organizations that can demonstrate as applicable:

- Must be an entity classified under one the following NAICS codes:

- NAICS code 611 (Educational services)

- NAICS code 62 (Social assistance and health care organizations [inclusive of NAICS code 624210])

- NAICS code 813 (Religious, grantmaking, civic, professional, and similar organizations)

- NAICS code 92 (Public administration)

- Check against the Federal System for Award Management (SAM) to ensure entity is not debarred.

- Good standing with the Department of Labor, with all decisions of good standing at the discretion of the Commissioner of the Department of Labor; and

- A tax clearance certificate from the New Jersey Division of Taxation

- Demonstrated capacity of bulk meal purchase and distribution from New Jersey-based restaurants (i.e., NAICS code 722 or 624210) of at least 1,500 meals costing at least $25,000 between March 9, 2020 and the date of application launch.

- Meal donations from restaurants may be counted toward up to 50% of the past purchase requirement (up to 750 meals and $12,500), so long as the applicant can produce invoices from restaurant donors verifying the number of meals and monetary value of the donated meals

- Can demonstrate that the organization has experienced increased costs as a result of the pandemic’s impact

Phase 3 Participating Restaurant Eligibility Criteria

Changes in bold represent changes from Phase 1 and 2 of the program

Grant applications must also demonstrate, as part of the grant application or restaurant addition period, the following requirements were met by restaurants from which the grant applicants will be bulk purchasing meals:

- Restaurant is classified as “Food Services and Drinking Places” under NAICS code 722 or “Community meals, social services” under NAICS code 624210

- 50 or fewer full-time equivalent (FTE) employees at time of application, based on the company’s most recently filed WR-30 with NJDOL or if no WR-30 is available, IRS form 1040 verifying the restaurant has no FTE employees

- Physical commercial location in New Jersey

- Good standing with the Department of Labor, with all decisions of good standing at the discretion of the Commissioner of the Department of Labor

- Check against the Federal System for Award Management (SAM) to ensure entity is not debarred.

- If the restaurant is regulated by the Division of Alcoholic Beverage Control (ABC), then it must also be in good standing with ABC, with all decisions of good standing at the discretion of the ABC

- Current and valid certification from municipal and/or county government inspection that the restaurant has received a rating of Satisfactory as per New Jersey Retail Food Establishment Rating system

- Satisfaction of the requirement by the New Jersey Division of Taxation with regard to taxes, which may be through a tax clearance certification or verification from the Division of Taxation that the restaurant is in good standing and does not have tax debts due to the State

- Attestation from the restaurant that they were in operation on June 4, 2021, and that they have been negatively impacted by the COVID-19 (e.g., has had a drop in revenue, has been materially impacted by employees who cannot work due to the outbreak, or has a supply chain that has materially been disrupted and therefore slowed firm-level production).

Grant applicants/recipients will be responsible for providing to the Authority any necessary supporting information and documentation from on behalf of the restaurants to verify eligibility – whether that be as part of the application process, prior to grant agreement, or following execution of a grant agreement as part of an audit the Authority, U.S. Treasury, or any other relevant State or federal entity reserves the right to may conduct against the certifications provided at application.

Once verified as eligible, participating restaurants’ information may be posted publicly on NJEDA’s website.

Community meal/social services entities operating under the NAICS code 624210 are unique in that they may apply directly for Sustain & Serve NJ and serve as grantee organizations. However, any grant applicant classified under NAICS code 624210 cannot also serve as a meal provider for their organization or for any other Sustain & Serve NJ applicant or grantee organizations (i.e., they cannot purchase meals from themselves and other grantees cannot purchase from them). Entities under NAICS code 624210 that choose to apply directly as a grantee organization must include in their application at least one other restaurant(s) from which they will purchase meals. Applicants classified under NAICS code 624210 may purchase meals from other entities under 624210, but they must not share an Employer Identification Number (EIN). Finally, entities under NAICS code 624210 that serve as meal providers (i.e., not a grantee) may work with one or more applicants.

AWARD

Changes in bold represent changes from Phase 1 and 2 of the program

In all phases, eligible entities may receive reimbursement-based grants from $100,000 to $2,000,000 to support costs associated with the bulk purchasing of meals from New Jersey-based restaurants. In Phase 3, grantees may use up to 10% of their grant award toward direct organizational costs associated with the implementation of Sustain & Serve NJ limited to:

- Staff salaries and fringe (proportionate to the amount of staff time dedicated to the program)

- Mileage for meal deliveries completed by the grantee organization

- Payments to vendors that assist with monitoring and invoicing meal purchases (e.g., an accounting or professional services firm)

- Supplies needed to operate the program

All other funds must be used for the purchase of meals from participating New Jersey-based restaurants, with reimbursement capped at $12 per meal in Phase 3, increased from $10 per meal in Phases 1 and 2.

Once the Authority receives all applications, if the total amount grant funding requested among all eligible applications exceeds the funding available for this program, the Authority will prorate grant awards based upon the amount determined by staff for each eligible applicant, reducing all grant awards to reflect an eligible applicant’s share of the eligible pool. If the pool of available funds for Sustain and Serve NJ awards cannot be prorated such that each grantee would receive a minimum $100,000 award, the Authority will split the funds equally across all eligible applicants.

List of Phase 1, 2 and 3 grantees can be found in the below press releases:

NJEDA to Award $20 Million in Grants to 29 Entities Statewide Through Phase 2 of Sustain & Serve NJ

NJEDA to Award $14 Million in Grants to 27 Entities Statewide Through Sustain & Serve NJ

PROGRAM GUIDE

QUESTIONS

For more information or to ask a specific question please send an email to ssnj@njeda.com and a team member will reach out to you.