NEXT NEW JERSEY MANUFACTURING PROGRAM

NJEDA is now accepting applications, as of Thursday, September 25, 2025, at 10:00 am EDT, and will remain open until all funds are committed or March 1st, 2029; whichever comes first.

Program Information

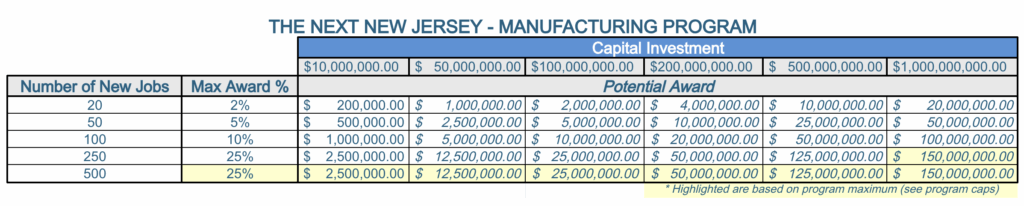

An eligible manufacturing applicant may be awarded a tax credit of up to $150 million, based on their proposed new jobs and capital investment. To determine your potential award amount, please utilize our Awards Calculator.

An eligible manufacturer will receive a tax credit based on the lowest of the following three calculated amounts:

Award Calculation: Multiply 0.1% by the capital investment, then multiply that result by the total number of jobs.

Program Award Percentage Cap: Max of 25% of your total capital investment.

Program Award Cap: Max award amount $150 million.

Your final tax credit amount will be the smallest of these three values (Award Calculation, or the two Caps).

The Next NJ Manufacturing Program is a tax credit initiative designed to spur significant investment, create new manufacturing jobs, and solidify New Jersey’s manufacturing industry.

By competitive, transferable tax incentives, NEXT NJ Manufacturing encourages companies to invest their capital in New Jersey while demonstrating a collaborative commitments to long-term growth within the state.

The Qualified Business facility is primarily (>50%) engaged in manufacturing.

“Manufacturing” does not include refurbishing or repairing goods, retail, wholesale, packaging, software development, resource extraction, waste incineration, or any agriculture (indoor, outdoor, hydro or aeroponic).

PROGRAM RULES

The NJEDA has adopted the following new rules to implement the provisions of the Next NJ Manufacturing Program:

ELIGIBILITY

To be eligible for the Next NJ Manufacturing Program, a project must:

- The business shall make, acquire, or lease a capital investment at the qualified business facility not less than $10,000,000;

- The business shall create new full-time jobs at the qualified business facility in an amount not less than 20 new full-time jobs;

- The Qualified Business facility needs to be primarily involved in manufacturing activities (> 50% of the business’s activities).

- “Manufacturing” does not include refurbishing or repairing goods, retail, wholesale, packaging, software development, resource extraction, waste incineration, or any agriculture (indoor, outdoor, hydro or aeroponic).

4. The median salary of the full-time jobs at the qualified business facility by the business shall be not less than 120 percent of the median salary for manufacturing employees in the county in which the project is located; or if the qualified business facility is a complex of buildings that spans multiple counties, the county with the highest median salary among the counties where the buildings comprising a complex of buildings are located;

5. The business shall maintain the facility as a qualified business facility during the commitment period;

6. The business shall enter into a collaborative relationship;

A “Collaborative relationship” means a contractual relationship, as approved by the Authority, over the term of the commitment period, which may be renewed annually, between an eligible business and a New Jersey-based:

- public or private university or college;

- public or private high school;

- workforce development organization;

- vocational or technical school or institution;

- labor organization, business or employer association, or nonprofit community-based organization that provides workforce training, apprenticeship, and career development services;

- entities or consortia made up of the previous 5 examples that develop and deliver workforce training programs; or

- any combination thereof.

7. The qualified business facility shall be in compliance with minimum environmental and sustainability standards;

8. The project shall comply with the Authority’s affirmative action requirements; and

9. Each worker employed to perform construction work or building services work at the qualified business facility shall be paid not less than the prevailing wage rate for the worker’s craft or trade, as determined by the Commissioner of Labor and Workforce Development.

Find Resources: Regulations, forms, and guidance documents are available at: www.njeda.com/affirmativeaction

AWARD SIZE

Awards Calculation

Tax credit award per business is based on the lesser of:

- 0.1% of the eligible business’s total capital investment multiplied by the number of new full-time jobs; or

- 25% (Max Percentage) of the eligible business’s total capital investment; or

- $150 million (Max Award)

Enter your values to calculate the eligible amount. The award amount will be determined by the lesser of the following three options:

Option 1: Multiply 0.1% by the capital investment, then multiply that result by the total number of jobs, or

Option 2: Take 25% of the capital investment, or

Option 3: The program is cap of $150 million.

Job minimum: 20

Capital investment minimum: $10,000,000

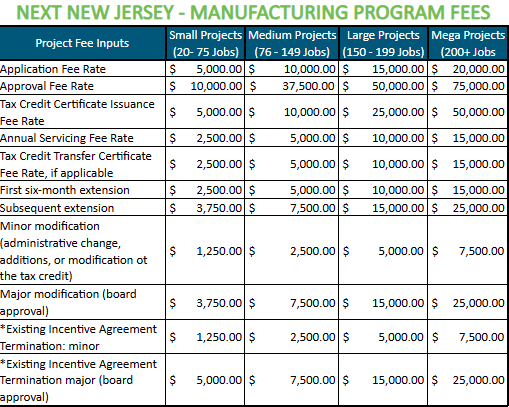

FEES

Stackable 1% Bonuses available for each of the following:

- Opportunity Zone Eligible Census Tract: Location Review App (mapping tool)

- New Jersey Business Certifications (1% for each):

- NJ Minority Owned Business or Enterprise (MBE)

NJ Woman Business Enterprise (WBE)

Note: Minority/Woman Owned Business or Enterprise (M/WBE) would be eligible for 2%

NJ Veteran-Owned Business (VOB) or Disabled Veteran-Owned Business (DVOB)

NJ Small Business Enterprise (SBE)

NJ Emerging Small Business Enterprise (ESBE) or Disadvantaged Business Enterprise (DBE)

NJ Lesbian, Gay Bisexual, Transgender, Queer, Questioning (LGBTQ+)

NJ Urban Enterprise Zone (UEZ)

NJ Socially and Economically Disadvantaged Business (SEBD)

- NJ Minority Owned Business or Enterprise (MBE)

- At least one Active Collective Bargaining Agreement or Labor Harmony Agreement in place

Bonus is calculated off the annual award not to exceed a Maximum Bonus of 5% and Maximum Total Award Amount of $150,000,000.00

The following information provides additional resources around PUBLIC WORKS CONTRACTOR RESOURCES:

When is registration with NJ Department of Labor’s Public Works Contractor, the New Jersey Prevailing Wage Act, and Affirmative Action required?

- If the Project is expected to involve construction, reconstruction, demolition, custom fabrication, repair work, or maintenance work, including painting and decorating costs, using contractors such as Plumber, Electrician, or Carpenter or any other construction trades for the purpose of installing the equipment, the Project will be required to comply with the NJ Department of Labor’s Public Works Contractor Registration Act, the New Jersey Prevailing Wage Act, and Affirmative Action.

What are the compliance steps required during the hiring process of a contractor(s)?

To Avoid loss of incentives, fines and penalties for non-compliance and to ensure fair compensation for construction workers:

- Register: All contractors and subcontractors must be registered with the NJ Department of Labor and provide proof of valid registration. This applies to new contracts (awarded after April 1, 2020) requiring prevailing wage payments. Contracts that were awarded prior to April 1, 2020, do not have to provide proof of Contractor Registration Certification.

- Apprenticeship Programs: An important requirement from the NJ Department of Labor regarding Public Works Certification. As part of their application review process, all contractors must provide proof that they participate in a US-registered apprenticeship program, effective since May 1, 2019. It is also essential to ensure that your subcontracts adhere to this requirement.

- Find Resources: Regulations, forms, and guidance documents are available at: www.njeda.com/affirmativeaction

By following these instructions, you can ensure your construction project, for the purpose of installing the equipment complies with New Jersey’s labor and affirmative action regulations.

QUESTIONS

For more information or to ask a specific question, please send an email to nextnjmfg@njeda.gov and a team member will reach out to you.