The Economist’s Corner – November 13, 2020

By Richard Kasmin, NJEDA Chief Economist

Our biweekly look at a few key economic indicators and what they can tell us about the state of New Jersey’s economy.

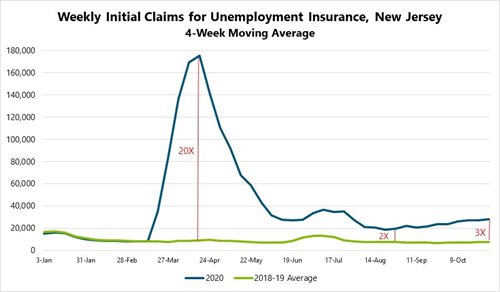

Indicator 1 – Weekly Initial Claims for Unemployment Insurance

Source: New Jersey Department of Labor

If a macroeconomist is stranded on a desert island and can only have a few economic indicators with which to understand the state of the economy, weekly filings of initial claims for unemployment insurance is a clear choice. Why? Well, for starters, these filings are generally the result of people recently losing their employment and seeking unemployment insurance coverage. Knowing something about the rate at which people are losing jobs is key to understanding how an economy is performing. In general, layoffs and new job creation as businesses come and go and expand and contract are natural components of a healthy economy. Analyzing shifts in the level of initial claims can provide key information about the state of the economy.

In that vein, the chart above shows weekly initial claims for unemployment insurance in 2020 (the dark blue line), and the average for 2018 and 2019 (the green line). During the worst of this year’s economic freeze, initial claims surged to around 20 times the level seen in recent years. But as the economy reopened, initial claims moderated considerably, settling down to around double previous years’ levels. That was relatively good news as it showed labor demand was rebounding; firms were less likely to lay off workers as they became more confident in the pace of economic recovery.

But, in recent months, something concerning has occurred. Instead of the relative level of initial claims continuing to recede as the economy picked up momentum, claims actually increased to around three times the level seen at this time in prior years. That suggests layoffs are rising again, which could be a sign of rising economic challenges in the near future.

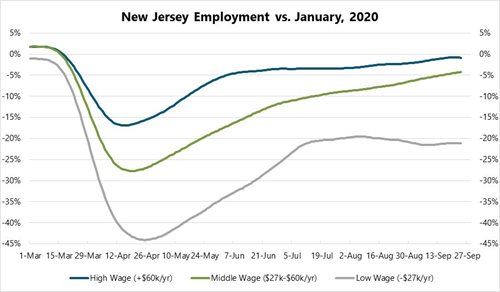

Indicator 2 – Employment by Wage Cohorts

Source: Opportunity Insights Economic Tracker

It goes without saying that COVID-19 has not impacted all segments of the economy in equal measure. Economic shocks never do, but the fallout from this shock seems especially lopsided, with those households that can least afford it taking the brunt of the shock.

As the above chart shows, relatively lower-wage jobs have taken the largest economic hit and have struggled to recover. Lower-wage jobs are more likely to be in face-to-face industries, and we know this is where COVID-19 has had an outsized impact. Low-wage employment is still around 20 percent below where it was before the pandemic. Higher-wage employment certainly took a considerable hit but has recovered much more as a considerable share of these jobs can be done from home.

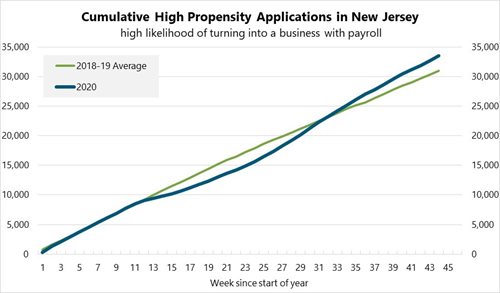

Indicator 3 – High Propensity Business Applications

Source: US Census Bureau

One of the more curious things to happen in New Jersey, and the country for that matter, is the surge in applications for business tax identification numbers. These applications precede the creation of new businesses. In the case of so-called high propensity business applications depicted in the chart above, these are applications to create businesses having a high likelihood of turning into businesses with payroll. Thus, these applications signal the creation of new employer businesses. As the chart shows, cumulative applications in 2020 are around eight percent higher than they were at this time of year in 2018 or 2019. Given all the negative impacts COVID-19 is having on the economy, this is a bright spot as it suggests a surge in entrepreneurial spirit despite (or because of?) the virus.

Some analysts wonder if the surge in applications is merely reflective of a backlog of applications being processed. Others wonder if the destruction of so many small businesses and jobs is leading to creation of new businesses by the owners of now defunct businesses creating sole proprietorships. This could negate the expectation that these new businesses will create jobs. In other words, this jump in applications might not reflect a surge in job-creating new businesses but a jump in sole proprietorship creation reflective of all other income generating options being exhausted.

The jury is out for now, but in the short term this could be a positive sign that creative destruction and entrepreneurial spirit is alive and well in New Jersey and the US.

Related Content

April 24, 2024

NJEDA Awards First $2M under Angel Match Program to Support Early-Stage Technology Companies

TRENTON, N.J. (April 24, 2024) – The New Jersey Economic Development Authority (NJEDA) has closed its first four approvals under the Angel Match Program, awarding a total of $2 million to support early-stage technology companies.

April 15, 2024

NJEDA Establishes New Jersey Green Bank to Advance Climate Goals

TRENTON, N.J. (April 15, 2024) – Last week, the New Jersey Economic Development Authority (NJEDA) Board approved the creation of the New Jersey Green Bank (NJGB), which will make investments in the clean energy sector that will help advance the state’s efforts to make an equitable transition to 100 percent clean energy.

April 12, 2024

NJEDA Board Approves Anchor Tenants for Maternal and Infant Health Innovation Center

TRENTON, N.J. (April 12, 2024) – The New Jersey Economic Development Authority (NJEDA) Board on Wednesday approved three anchor tenants to lead the Maternal and Infant Health Innovation Center (MIHIC) in Trenton.