NEXT NEW JERSEY PROGRAM – AI

Program Information

The tax credit amount to an eligible business is calculated based on the lesser of:

• 0.1 percent of the eligible business’s total capital investment multiplied by the number of new full-time jobs; or

• 25 percent of the eligible business’s total capital investment; or

• $250 million.

The Next NJ Program – AI provides tax credits to eligible businesses to offset against their state tax liability and for companies to engage in building and fostering New Jersey’s fast-growing AI ecosystem. Additionally, these tax credits are transferable under the program.

AI business or a division must be primarily engaged in the artificial intelligence industry or the large-scale artificial intelligence data center industry.

PROGRAM RULES

The NJEDA has adopted the following new rules to implement the provisions of the Next NJ Program -AI:

Next New Jersey Program Act, P.L. 2024, c. 49

ELIGIBILITY

AI business or a division must be primarily engaged in the artificial intelligence industry or the large-scale artificial intelligence data center industry.

To be eligible for the Next NJ Program-AI support, a project must:

- Meet minimum job creation requirements: 100 new full-time jobs in New Jersey

- Each job must be paid at least 120% of the county median salary

- Minimum Capital Investment: $100 million at the qualified business facility (including multiple locations)

- Collaboration: the business will enter into a collaborative relationship, evidenced by the provision of price concessions, artificial intelligence support services, or other measures determined appropriate by the Authority, with a New Jersey-based public or private research university or technology startup company, incubator, accelerator or both.

- More than 50% of the business’s or division’s employees are engaged in AI-related activities, or

- More than 50% of the business’s or division’s revenue is generated from AI-related activities, or

- Both of the above.

*** ***AI-related activities include but are not limited to: Developing new AI algorithms and techniques, such as machine learning, natural language processing, and computer vision; creating AI-powered software and hardware products for various applications; medical AI modelling or programing; development of AI chatbots for customer service; AI development for vehicles, and collecting, storing, and managing the vast amount of data needed to train and use AI models.

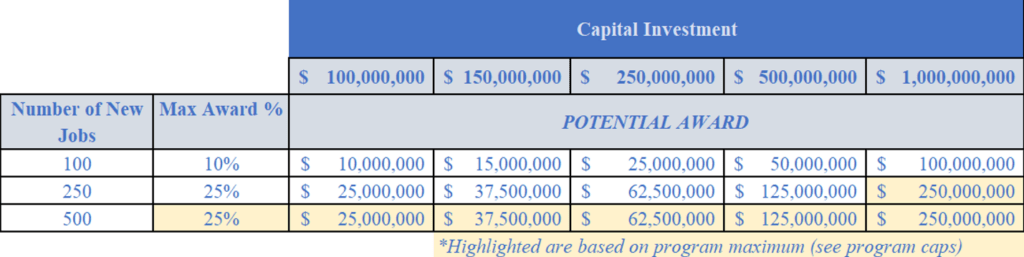

AWARD SIZE

Awards Calculation

Tax credit award per business is based on the lesser of:

- 0.1% of the eligible business’s total capital investment multiplied by the number of new full-time jobs; or

- 25% (Max Percentage) of the eligible business’s total capital investment; or

- $250 million (Max Award)

Enter your values to calculate the eligible amount. The award amount will be determined by the lesser of the following three options:

- Option 1: Multiply 0.1% by the capital investment, then multiply that result by the total number of jobs, or

- Option 2: Take 25% of the capital investment, or

- Option 3: The program is cap of $250 million.

Job minimum: 100

Capital investment minimum: $100,000,000

FEES

QUESTIONS

For more information or to ask a specific question, please send an email to nextnjai@njeda.gov and a team member will reach out to you.