ASPIRE PROGRAM

Please be advised that the Aspire Program has a limited number of uncommitted tax credits available for Transformative and non-Transformative projects alike. As such, there may be delays in the review and approval process for your project. We anticipate an increase in credits available starting in July 1, 2026 (FY 2027). If you have any specific questions about the availability of credits, please reach out to Aspire@njeda.gov.

On January 23, 2025, Governor Murphy signed Senate Bill 1323/Assembly Bill 2076, which revises various provisions of the Aspire program. As a result, certain information on this webpage may be updated. Please send any questions to aspire@njeda.gov.

Aspire is a gap financing tool to support commercial, mixed use, and residential real estate development projects that replaces the Economic Redevelopment and Growth Grant (ERG).

ELIGIBILITY

To be eligible for Aspire support, a project must:

- Demonstrate through NJEDA analysis that without the incentive award, the redevelopment project is not economically feasible.

- Demonstrate that a project financing gap exists and/or the redevelopment project will generate a below market rate of return.

- Be located in a designated “Incentive Area.”

- Include developer who has an equity participation of at least 20 percent of the total cost.

- Result in a net positive benefit to the State.

- Meet specific cost thresholds (for residential projects), depending on where the project is located.

Please be advised: New Jersey State law prohibits most cannabis license and certification holders from receiving or continuing to receive an economic incentive from the NJEDA. If the applicant, or any person who controls the applicant or owns or controls more than one percent of the stock of the applicant, has applied for or received a license or a certification from the New Jersey Cannabis Regulatory Commission (NJ-CRC), the applicant is ineligible for this program and should not proceed with an application. If an application is received from an applicant that meets this criteria, the application will be declined and the application fee will not be refunded.

PROJECT CAPS

- 85% of eligible costs up to $120 Million for projects located in Atlantic City, Trenton, and Paterson

- 80% of eligible costs up to $120 Million for projects located in Camden, East Orange, and New Brunswick

- 60% of eligible costs up to $90 Million for LIHTC projects or projects located in a qualified incentive tract or enhanced area municipality with a MRI Distress Score of at least 50

- Enhanced areas include: Jersey City, Newark, Elizabeth, Passaic, Hoboken, Paulsboro, Salem

- 50% of eligible costs up to $60 million for all other eligible projects

- Transformative caps are the same percentages noted above but up to $400 Million

- Tax Credits are disbursed over a ten-year period. Certain projects in GRMs are disbursed either in five- or ten-year period

FISCAL AND RESIDENT PROTECTIONS

To demonstrate local support for the project, the developer must have a letter of support for project from the chief executive of the municipality and must enter into a Community Benefits Agreement and also a Redevelopment Agreement with the project’s municipal governing body.

APPLICATION

NJEDA is currently accepting applications for the Aspire program.

Consultation with Aspire program staff prior to beginning work on an application is advised because completing the application will require focused time and attention on the applicant’s part; because Aspire program eligibility rules are nuanced; and because application fees are non-refundable.

Aspire program rules are available here for review.

If you are interested in applying for the Aspire Program, please contact an Aspire Program team member at Aspire@NJEDA.gov

The application link can be found here.

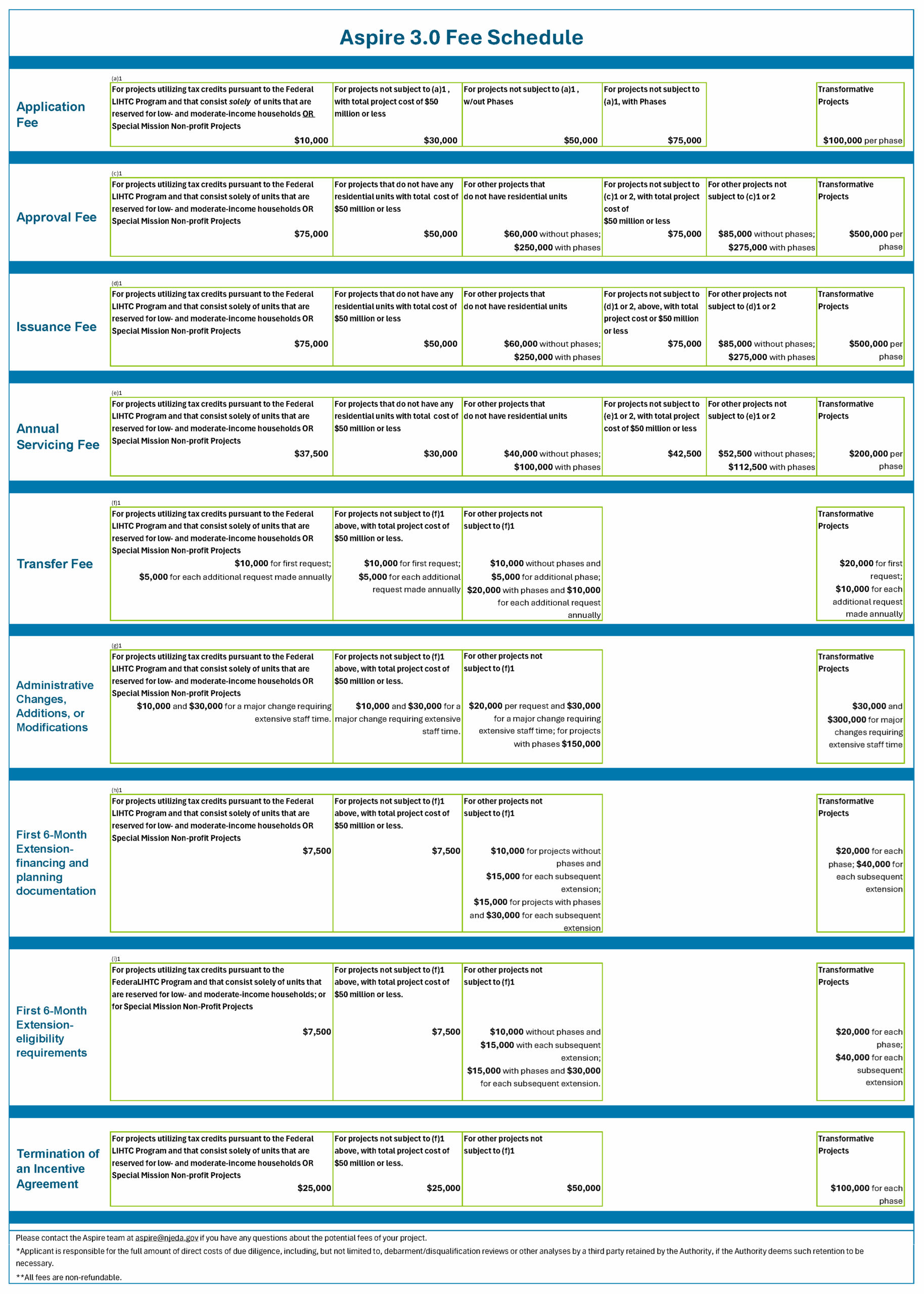

FEES

Click table to enlarge.

Please contact the Aspire team at aspire@njeda.gov to discuss the potential fees of your application.

* Applicant is responsible for the full amount of direct costs of due diligence, including, but not limited to, debarment/disqualification reviews or other analyses by a third party retained by the Authority, if the Authority deems such retention to be necessary.

** All fees are non-refundable.