New Jersey Household Debt and the Impact of Forbearance

New Jersey households, on average, hold more debt than households in the rest of the US. This is largely a function of home prices being higher than the US average, and mortgage debt accounts for more than 70 percent of New Jersey household debt. Debt becomes a particular concern during a recession, as the income used to service that debt (pay back interest and principle) can fall or dry up altogether, causing debt payment delinquencies, housing foreclosures, and bankruptcy.

Unlike during other economic downturns, federal and state governments have stepped in to forestall the impact of household debt during the pandemic. These governments have acted in two main ways to provide relief to consumer balance sheets: providing funds directly to households to bridge the income gap and through forbearance on federally-backed debts. The CARES Act provided for a six-month moratorium on payments of federally guaranteed mortgages and student loans. These forbearance periods are renewable for up to twelve months. Moreover, some private lenders voluntarily provided forbearance for auto and other types of loans.

The result has been an actual decline in delinquency rates, foreclosures, and household bankruptcies during the time of the pandemic. Thus, the government’s actions have had a clear positive impact on household balance sheets, reflected in the following charts. But there are significant questions ahead for policy makers. When forbearance ends and households are required to restart payments, will employment and household income have recovered sufficiently to stave off this renewed stress on household balance sheets? The answer to this question will have significant implications for the economy.

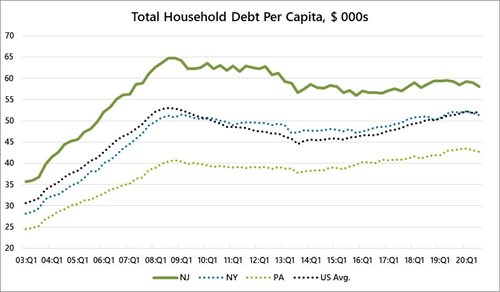

Indicator 1 – Household Debt Per Capita

Source: Federal Reserve Bank of New York

New Jersey households hold more debt per capital than the US as a whole. Over 70 percent of New Jersey household debt – approximately $41,000 per household – is in the form of mortgage debt. This mortgage debt share is a bit above the national average of 69 percent. It is interesting to note debt per capita in New Jersey has never rebounded to the level it was at before the Great Recession, which is not the case in other states in the region or for the US as a whole. It is possible New Jersey households on average became more risk-averse than those in other areas of the country. It is also likely an aging population in New Jersey plays some role, as does a lower home ownership rate relative to pre-2008, although these are also factors for the rest of the US.

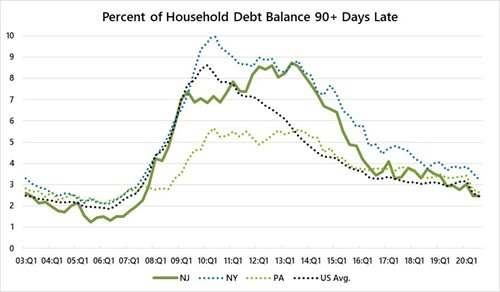

Indicator 2 – Percent of Household Debt Balance 90+ Days Delinquent

Source: Federal Reserve Bank of New York

Delinquency rates in New Jersey and the rest of the country have dropped, reflecting the uptake in CARES Act and voluntarily provided forbearance. There are two main impacts of forbearance. One is obvious – the ability to skip or defer debt payments. The other is protection of borrowers’ credit records.

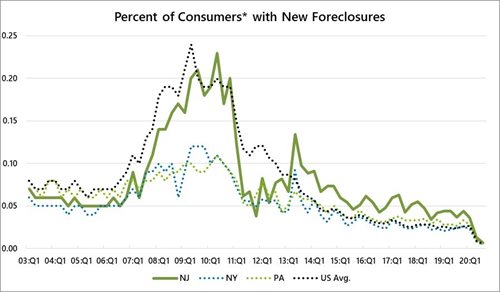

Indicator 3 – Percent of Consumers with New Home Foreclosures

Source: Federal Reserve Bank of New York

*Consumers with credit reports

Federally backed mortgages are protected from foreclosure through the CARES act. Thus, foreclosure rates are at all-time lows. In the third quarter of 2020, less than one percent of consumers underwent new home foreclosures.

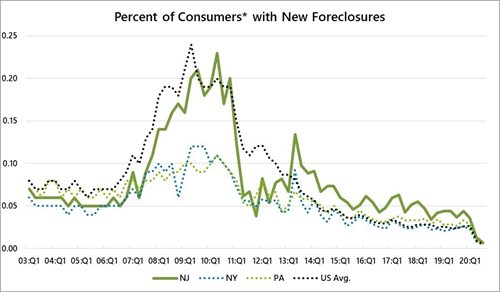

Indicator 4 – Percent of Consumers with New Bankruptcies

Source: Federal Reserve Bank of New York

*Consumers with credit reports

Moratoriums on debt payments have brought bankruptcy rates to all-time lows. This experience is quite different than what occurred in the immediate aftermath of the Great Recession, when bankruptcy rates in New Jersey tripled.

Related Content

April 25, 2024

NJEDA to Open Applications for 2024 NOL Program

TRENTON, N.J. (April 25, 2024) – The New Jersey Economic Development Authority (NJEDA) is opening applications for the 2024 Technology Business Tax Certificate Transfer Program, commonly known as the Net Operating Loss (NOL) program, on Wednesday, May 1st.

April 24, 2024

NJEDA Awards First $2M under Angel Match Program to Support Early-Stage Technology Companies

TRENTON, N.J. (April 24, 2024) – The New Jersey Economic Development Authority (NJEDA) has closed its first four approvals under the Angel Match Program, awarding a total of $2 million to support early-stage technology companies.

April 15, 2024

NJEDA Establishes New Jersey Green Bank to Advance Climate Goals

TRENTON, N.J. (April 15, 2024) – Last week, the New Jersey Economic Development Authority (NJEDA) Board approved the creation of the New Jersey Green Bank (NJGB), which will make investments in the clean energy sector that will help advance the state’s efforts to make an equitable transition to 100 percent clean energy.