COVID-19 Outbreak

New Jersey Economic Development Authority (NJEDA)

Sustain and Serve NJ

Para ver esta información en español, haga clic aquí

Overview

On March 9, 2020, Governor Phil Murphy issued Executive Order 103, declaring a State of Emergency and a Public Health Emergency to ramp up New Jersey’s efforts to contain the spread of COVID-19. Governor Murphy has continued to extend the Public Health Emergency since that date.

Subsequent containment measures were implemented, including restrictions on public gatherings and mandated closure of non-essential businesses. While these measures are consistent with similar measures being taken nationally that are expected to limit the public’s exposure to COVID-19, there has been and will continue to be a significant adverse impact on the state’s economy.

Businesses classified as “Food Services and Drinking Places” under NAICS code 722 (described in this document as “Restaurants”), have been disproportionately impacted by COVID-19, because of caps on location dining and unusual costs incurred to adapt business models for safe operations.

With the Public Health Emergency in place and millions of New Jerseyans abruptly staying home, restaurant revenue has plummeted or disappeared, and many restaurants have had little choice but to change – or abandon – their operating model overnight, with some having to close their doors completely and lay off or furlough all staff. Many restaurants that have changed their operating model have rapidly shifted to a takeout-only model, which resulted in a significant reduction in staff.

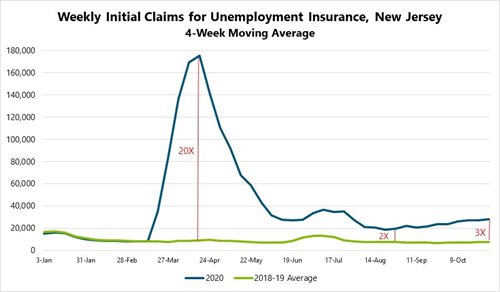

In 2019, according to the New Jersey Department of Labor and Workforce Development (NJDOL), 270,000 restaurant workers were employed in New Jersey. Since the beginning of the pandemic, as of October 31, NJDOL reports that 131,710 restaurant workers have filed Unemployment Insurance claims. In 2018, the National Restaurant Association reported there were over 19,000 restaurants in New Jersey.

Prior to the pandemic, the sector was growing, with NJDOL projecting the sector would expand by more than 12 percent by 2026. Now, the New Jersey Restaurant and Hospitality Association estimates as many as 30 percent of New Jersey restaurants remain at risk of permanent closure.

While these figures are staggering, they were likely mitigated, in part, due to several New Jersey-based initiatives that emerged in direct response to COVID-19, that share the same core function, i.e., the bulk purchase of pre-made meals from New Jersey restaurants, which were then distributed for free to target populations.

Specifically, these initiatives aimed to achieve two central goals: to provide urgently needed revenue to restaurants to offset direct losses due to COVID-19, particularly, restaurants that had temporarily closed, were preparing to close, and/or reduced their staff through layoffs or furloughs; and to distribute free meals purchased from local restaurants to target populations, including low-income individuals, senior citizens, health care workers, and first responders.

The Sustain and Serve NJ Program builds on prior New Jersey Economic Development Authority (NJEDA) initiatives supporting restaurants impacted by COVID-19.

Purpose

The purpose of the Sustain and Serve NJ Program is to provide urgently needed revenue to New Jersey-based restaurants to offset direct losses due to COVID-19, including restaurants that had temporarily closed, were preparing to close, and/or reduced their staff through layoffs or furloughs.

Under the program, up to $2 million will be utilized to make grants of at least $100,000 to certain entities to support prospective expenses for making bulk meal purchases from New Jersey-based restaurants negatively impacted by COVID-19.

As part of the Serve and Sustain NJ Program requirements, the grantee is prohibited from reselling any meals purchased with grant funding.

Eligible Uses

Under the Sustain and Serve NJ Program, grant funding may only be used for direct costs associated with bulk purchasing of meals that are projected to be incurred between date of grant execution and April 30, 2021, for: the restaurant’s costs of food and ingredients; labor, packaging, and facilities; and, any profit margin for the restaurant.

However, no other expense(s) incurred by the applicant, whether in support of the meal purchase from the restaurant or otherwise, is eligible, including, but not limited to: indirect/overhead costs incurred by the applicant (e.g., rent, insurance), transportation, distribution, marketing, communications, sales tax and gratuity.

Grant Amounts

The Sustain and Serve NJ Program offers a minimum grant amount of $100,000, with grant awards calculated based on the projected number of meals to be purchased and estimated cost (per meal), excluding sales tax and gratuity.

Under the Sustain and Serve NJ Program, all meal purchases will be reimbursed based on a flat rate per meal. Although there is no exclusion for entities purchasing meals from restaurants at more than $10 per meal, grant funding will be capped at $10 per meal.

As part of the application for grant funding, entities will request a grant amount based on the projected number of meals to be purchased and estimated cost (per meal), excluding sales tax and gratuity. All grant estimates must be based on a flat rate per meal, subject to the cap of $10 per meal. For any grant that is awarded, disbursement of the total grant amount will be made incrementally from NJEDA to the grantee as eligible expenses are incurred and disbursement is requested by the grantee. These disbursement requests must document that the expenses actually incurred are consistent with eligible uses of grant funding (i.e., the quantity of meals purchased, the cost per meal, and the restaurant from which the meals were purchased).

Once the NJEDA receives all applications, if the total amount of grant funding requested among all eligible applications exceeds the $2 million available for the Program, NJEDA will prorate grant awards based upon the amount determined for each eligible applicant, reducing all grant awards to reflect an eligible applicant’s share of the eligible pool.

Eligible Applicants

Restaurants may not directly apply for this grant. Restaurants interested in the program are recommended to contact an entity with an established bulk meal purchasing and distribution program to discuss potential participation. Restaurants may also opt to have their business publicly listed on the Sustain and Serve NJ page of the New Jersey COVID-19 Business Hub expressing interest in being a participating restaurant that Sustain and Serve NJ applicants can reach out to for bulk meal purchases. To list your restaurant, please fill out this form. Potential grant applicants may choose to refer to this registry and contact restaurants about participating in the Sustain and Serve NJ program.

The Sustain and Serve NJ Program is limited to public or private entities, including 501(c) non-profit organizations. To be eligible, applicants shall provide the following documentation:

1. NJ Business Registration Certificate which may be obtained at https://www.state.nj.us/treasury/revenue/gettingregistered.shtml

2. Tax Clearance Certification from the Division of Taxation, in the Department of the Treasury which may be obtained at https://www.state.nj.us/treasury/taxation/busasst.shtml

3. Invoices and receipts demonstrating purchases of 3,000 or more meals made by the entity from any New Jersey-based restaurant(s) totaling at least $50,000, purchased between March 9, 2020 and December 16, 2020.

In addition, eligible applicants shall be in good standing with NJDOL, with all decisions of good standing at the discretion of the Commissioner of NJDOL.

As noted above, eligible applicants must have a demonstrated history of making bulk meal purchases from New Jersey-based restaurants during the current public health emergency totaling at least 3,000 meals valued at least $50,000 between March 9, 2020 and December 16, 2020.

As part of the grant application, applicants must list the restaurants that they will be making bulk meal purchases from as part of Sustain and Serve NJ. In order to receive reimbursement for meal purchases through Sustain and Serve NJ, grantees may only purchase meals from restaurants that meet the following requirements:

- Classified as “Food Services and Drinking Places” under NAICS code 722;

- 50 or less full-time equivalent employees at time of application, based on the company’s most recently filed WR-30 with DOL;

- Physical commercial location in the State of New Jersey;

- NJ Business Registration Certificate which may be obtained at https://www.state.nj.us/treasury/revenue/gettingregistered.shtml

- Be in good standing with the New Jersey Division of Taxation, with all decisions of good standing at the discretion of the Commissioner of the DOL

- Be in good standing with the DOL, with all decisions of good standing at the discretion of the Commissioner of the DOL;

- If regulated by the Division of Alcoholic Beverage Control (ABC), in the Department of Law and Public Safety, be in good standing with ABC, with all decisions of good standing at the discretion of the ABC;

- Current and valid certification from municipal and/or county government inspection that the restaurant has received a rating of Satisfactory as per New Jersey Retail Food Establishment Rating system; and

- Attestation that the restaurant was in operation on February 15, 2020, and has been negatively impacted by the COVID-19 declared state of emergency on March 9, 2020 (e.g., was temporarily shut down, was forced to reduce hours, has had a drop in revenue, has been materially impacted by employees who cannot work due to the outbreak, or has a supply chain that has materially been disrupted and therefore slowed firm-level production).

To demonstrate eligibility, restaurants will be required to submit to NJEDA:

1. Form attesting that the restaurant was in operation on February 15, 2020, and has been negatively impacted by the COVID-19 declared state of emergency on March 9, 2020. After the applicant submits their application, this form will be sent by NJEDA directly to listed restaurants.

2. NJ Business Registration Certificate which may be obtained at https://www.state.nj.us/treasury/revenue/gettingregistered.shtml; and

3. Current and valid certification from municipal and/or county government inspection that the restaurant has received a rating of Satisfactory as per New Jersey Retail Food Establishment Rating system.

Finally, businesses prohibited from eligibility include, but are not limited to: gambling or gaming activities; conduct or purveyance of “adult” (i.e., pornographic, lewd, prurient, obscene or otherwise similarly disreputable) activities, services, products or materials (including nude or semi-nude performances or the sale of sexual aids or devices); any auction or bankruptcy or fire or “lost our-lease” or “going-out-of-business” or similar sale; sales by transient merchants, Christmas tree sales or other outdoor storage; any activity constituting a nuisance; or, any illegal purposes.

Funding Disbursement

For each grant award, the total amount will be disbursed incrementally as eligible projected expenses are incurred and disbursement is requested from the NJEDA by the grantee. The disbursement requests must be evidenced by documentation supporting that the expenses were actually incurred and consistent with eligible uses of grant funding (i.e., quantity of meals purchased, cost per meal, and restaurant from which the meals were purchased).

During the term of the grant, the grantee may request a change or addition to participating restaurant(s), which must be submitted in writing, from which they may purchase meals and receive reimbursement through Sustain and Serve NJ. Requests for changes or additions to restaurants will be reviewed by NJEDA.

Application Process

Online applications will be accepted from December 16, 2020 through January 8, 2021, and all applications will be reviewed following the closure of the application period.

Applications for Sustain and Serve NJ are completed in three parts:

1. Applicants are first required to submit an application that includes listing proposed restaurants for meal purchases;

2. Listed restaurants will then receive a short form directly from NJEDA they must complete if they wish to be eligible for meal purchases through Sustain and Serve NJ; and

3. Applicants are sent the restaurant submission to review and approve before it is sent to NJEDA. Approvals must be completed by the application deadline for consideration for meal purchase reimbursement through Sustain and Serve NJ.

Applicants are responsible for ensuring restaurants have submitted materials by the application deadline. Applicants should allow sufficient time for submission of both their and listed restaurants’ materials.

Fees

Due to financial hardship of the ultimate beneficiaries, NJEDA will collect no fees from the applicant for this program.

Additional Information

Additional information on the Sustain and Serve NJ Program may be found at the COVID-19 Business Information Hub: https://business.nj.gov/covid/is-my-business-eligible-for-the-sustain-and-serve-program?locale=en.